-

If you’re buying a property, at some point the seller will no longer be accountable for the damage to the property and it becomes your responsibility.

But when is that? At exchange of contracts? At settlement? It’s important to find out so you know when you should have insurance in place. After all, a mistake could be very expensive. Should your home be hit in a storm during the settlement period you don’t want to discover too late that the damage is actually your responsibility to pay for!

The standard contract for sale in each state and territory offers a good starting position to understand when the risk of damage to the property might pass to the buyer.

However, it is important to note that your particular contract for sale may contain a special condition that varies the standard contract. So you should always engage a solicitor or conveyancer to check your contract so you can be certain when the risk of damage to the property passes to you.

What are the rules in my state?

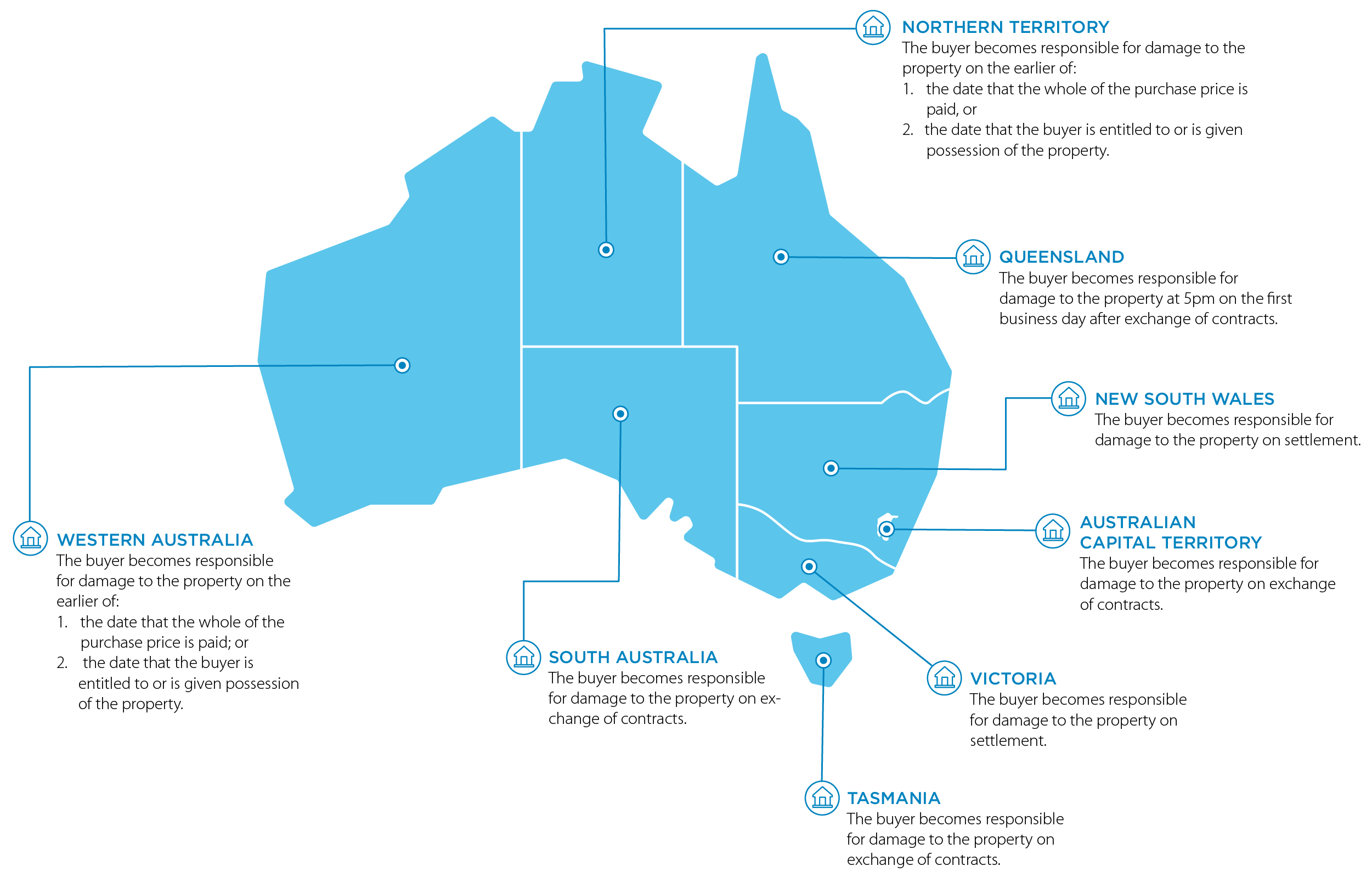

The standard position when the risk of damage to a property passes from seller to buyer varies from state to state.

Generally, risk passes to the buyer either on exchange of contracts (such as in South Australia and Tasmania) or at settlement (such as in New South Wales and Victoria).

Here’s a summary of the standard position in each state and territory which may be varied by your particular contract.

Victoria

The buyer becomes responsible for damage to the property on settlement.

New South Wales

The buyer becomes responsible for damage to the property on settlement.

Australian Capital Territory

The buyer becomes responsible for damange to the property on exchange of contracts.

Queensland

The buyer becomes responsible for damange to the property at 5pm on the first business day after exchange of contracts.

Northern Territory

The buyer becomes responsible for damange to the property on the earlier of:

1. the date that the whole of the purchase price is paid; or

2. the date that the buyer is entitled to or is given possession of the property.

South Australia

The buyer becomes responsible for damange to the property on exchange of contracts.

Western Australia

The buyer becomes responsible for damange to the property on the earlier of:

1. the date that the whole of the purchase price is paid; or

2. the date that the buyer is entitled to or is given possession of the property.

What about strata schemes?

In strata schemes, the buyer of a lot isn’t usually responsible for purchasing building insurance because the building itself is considered common property. The owners’ corporation will handle it. But you should check with your lawyer or conveyancer whether you need to consider purchasing insurance, just in case. For example, the building insurance policy held by the owners’ corporation may not cover internal fixtures such as floorboards.

You may also want to consider a contents insurance to cover your possessions.

Better safe than sorry?

Some buyers get home insurance as soon as the contract is signed in case the seller does not have adequate insurance in place.

Some lenders will insist that the buyer does this. If in doubt, ask your lender.

If this applies to you, you should check that your insurance policy commences from the date that contracts are exchanged.

Fraud protection.

Now it's personal.

ANZ Falcon® technology monitors millions of transactions every day to help keep you safe from fraud.

Falcon® is a registered trademark of Fair Issac Corporation.