Fraud protection.

Now it's personal.

ANZ Falcon® technology monitors millions of transactions every day to help keep you safe from fraud.

Falcon® is a registered trademark of Fair Issac Corporation.

Fraud protection.

Now it's personal.

ANZ Falcon® technology monitors millions of transactions every day to help keep you safe from fraud.

Falcon® is a registered trademark of Fair Issac Corporation.

Fraud protection.

Now it’s personal.

ANZ Falcon® technology monitors millions of transactions every day to help keep you safe from fraud.

Falcon® is a registered trademark of Fair Isaac Corporation.

An ANZ Access Visa Debit card allows you to pay for your purchases using your own money through the Visa or eftpos network. ANZ Access Visa Debit is a feature of a number of ANZ accounts, such as ANZ Access Advantage, ANZ One offset, ANZ Pensioner Advantage and ANZ Access Basic accounts.

The ANZ Access Visa Debit card offers the flexibility of accessing your everyday transaction account with the added benefit of access to the worldwide Visa network.

For more information, please read the following ANZ Access Visa Debit frequently asked questions or refer to the ANZ Access Visa Debit guide (PDF).

ANZ Access Visa Debit is a feature of a number of ANZ accounts, such as ANZ Access Advantage, ANZ One offset, ANZ Pensioner Advantage and ANZ Access Basic accounts.

ANZ Access Visa Debit card offers the convenience of access to the worldwide Visa and domestic eftpos network, allowing you to shop online, overseas or over the phone with your own money. You can also use your card to withdraw cash and pay bills.

Please visit My first Visa Debit card page.

A number of ANZ accounts, such as ANZ Access Advantage, ANZ One offset ANZ Pensioner Advantage and ANZ Access Basic accounts, now come with an ANZ Access Visa Debit card.

The ANZ Access Visa Debit card allows you to access your money everywhere Visa is accepted. The ANZ Access Visa Debit card will allow you to withdraw cash, pay bills and make purchases on the internet, overseas and by telephone using your own money.

To find out more about the benefits of an ANZ Access Visa Debit card, please refer to ANZ Access Visa Debit, alternatively call us anytime on 13 13 14 or visit your local branch.

You can activate your card and set your card PIN in the ANZ App in just a few taps.

An ANZ Access Visa Debit card allows you to pay for your purchases using your own money through the Visa or eftpos network, while a credit card provides you with the ability to access credit, which you then repay at a later date.

Visa Debit offers the flexibility of accessing your everyday transaction account. at many retailers around the world including online, over the phone or overseas. So now you can make purchases like flights or concert tickets online or over the phone using your ANZ Access Visa Debit card.

Customers aged 12 years or over that have an Australian mailing address are eligible to apply for a ANZ Access Visa Debit carddisclaimer.

Simply apply for one of the following eligible accounts, such as;

Or you can:

Please note hearing or speech impaired customers can utilise the TTY service: 1800 651 546

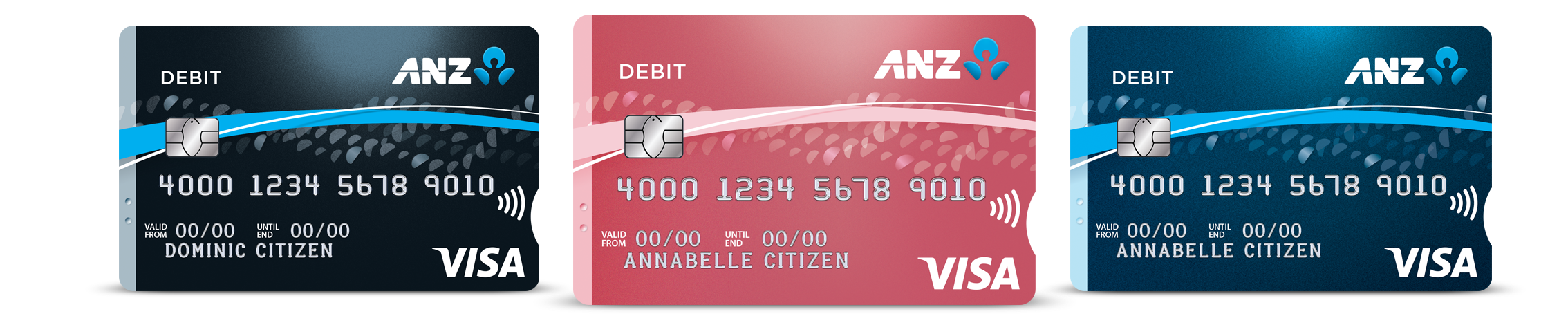

Yes. You have the choice between a blue, pink or black ANZ Access Visa Debit card. You will be asked to nominate your preferred card colour during the application process. The blue card is the default design and will be provided if no selection is made.

Visa payWave is a new contactless payment feature on the ANZ Access Visa Debit card allowing you to pay for purchases up to the contactless limit without swiping, signing, or entering a PIN at any merchants who have a contactless terminal.

For more information, please see Contactless payments.

The ANZ Access Visa Debit card is accepted at many retailers worldwide, wherever Visa is accepted. This includes at the point of purchase (EFTPOS), ATMs, online, over the phone or overseas.

There are many ways you can access your money using your ANZ Access Visa Debit card, including at ATMs, at the point of purchase, over the phone, online and via mail order.

A simple rule to remember is to select ‘Credit’ or 'Visa Debit' for all transactions, unless withdrawing cash with purchases where you select 'Savings' or 'eftpos SAV'.

When using your ANZ Access Visa Debit card for ATM transactions, select the 'credit' button to access your account.

| Transaction type | Press 'Credit' or select 'Visa Debit' | Press 'Savings' or select 'eftpos SAV' |

|---|---|---|

| ATM Balance Enquiry | ||

| ATM Cash Withdrawal (in Australia and overseas) | ||

| Purchases in Australia and overseas | ||

| Purchases in Australia with 'Cash Out' |

* Standard daily cash withdrawal limit applies. Refer to ANZ Savings & Transaction Products Terms and Conditions (PDF) for further details. A day begins at 12:00am (Melbourne time) and ends at the end of that same day.

Enjoy the added security of ANZ Falcon™ fraud monitoring for your ANZ Access Visa Debit card transactions - even when you’re shopping overseas or online. All transactions are automatically protected by ANZ Falcon™ which monitors your transactions for unusual or suspicious activity.

That's ok, you can still press 'Savings' or 'eftpos SAV'.

To make internet, phone or mail order purchases:

Yes. With an ANZ Access Visa Debit card, you can access your own money wherever Visa is accepted.

You can also make withdrawals from Visa ATMs whilst overseas and avoid carrying large amounts of cash.

When you're at an ATM or point of purchase, select 'Credit' or 'Visa Debit' (when the option is available) for transactions.

Keep in mind that Overseas Transaction Fees and Overseas ATM Transaction Fees may apply when you use your ANZ Visa Debit card overseas. Please refer to the ANZ Personal Banking Account Fees and Charges (PDF) for more information.

Transactions made in Australia and overseas on your ANZ Access Visa Debit card could be worry-free with the protection of ANZ Falcon™.

At ANZ, we have round-the-clock security procedures to help protect your ANZ Access Visa Debit card transactions. The advanced software of ANZ Falcon™ can detect oddities in your spend pattern. If a transaction is thought to be unusual or suspicious, ANZ will contact you to confirm if the transaction was yours. All transactions using your ANZ Access Visa Debit card are automatically protected by ANZ Falcon™.

Online purchases may be covered by the ANZ Fraud Money Back Guarantee and may be covered by Visa Secure (formerly known as Verified by Visa) and eftpos Secure.

Feel at ease with the ANZ Fraud Money Back Guarantee – you won’t be liable for fraudulent transactions on your ANZ card, provided you didn’t contribute to the loss and you notify ANZ promptly of the fraud.

Visa Secure (formerly known as Verified by Visa) or eftpos Secure: Benefit from added peace of mind when using your ANZ Access Visa Debit card on the Internet.

Visa Secure (formerly known as Verified by Visa) is a joint initiative between ANZ and Visa.

eftpos Secure is a joint initiative between ANZ and eftpos.

These offer you protection against the unauthorised use of your ANZ Access Visa Debit card for online shopping at participating Visa Secure (formerly known as Verified by Visa) or eftpos Secure merchants. At these merchants, Visa Secure (formerly known as Verified by Visa) and eftpos Secure allow you to identify yourself using your Visa Secure (formerly known as Verified by Visa) or eftpos Secure password.

When you have authorised another person or company (merchant) to transact on an ANZ Access Visa Debit card by providing your Visa Debit 16 digit card number or you have used your card to make a point of sale purchase by selecting the 'Credit’ or 'Visa Debit' option, you may be able to reverse the transaction where you have a dispute with the merchant. For example, you may be able to reverse a transaction where the merchant has not provided you with the goods and services that you paid for.

You should notify us immediately of a disputed transaction made using your ANZ Access Visa Debit card. Visa scheme time limits also apply. If after an investigation ANZ is satisfied that you are entitled to reverse a transaction, it will credit your account for the amount initially debited for the transaction.

Yes. You can arrange recurring transactions to other organisations like insurance or car repayments.

To set up recurring transactions with other organisations, provide them with your 16 digit card number and expiry date, and advise the card type is Visa. As an additional security measure some organisations may require the Card Validation Code (CVC) – the three digits on the back of your card.

A merchant involved in a transaction may obtain an authorisation for the transaction before the transaction is made. The authorisation is for the purpose of establishing that there are sufficient funds available in the account for the transaction.

An authorisation may reduce the amount of available funds in the linked nominated account (and the transaction may be shown as ‘pending’). If the purchase or other transaction is not completed, the amount of available funds in the account may continue to be reduced for a period of time.

As an example, when you pre-order goods or services such as car hire, or accommodation, the merchant is able to check if you have sufficient funds in your account. This is known as authorisation.

An ANZ Access Visa Debit card gives you all the benefits of the Visa network.

In addition to being accepted at many retailers globally, you will also have access to Visa Entertainment. Thanks to Visa and partners including Disney, Sony and Ticketek, you'll enjoy access to offers such as:

To find out more about the latest offers visit www.visaentertainment.com.au.

Visa Secure (formerly known as Verified by Visa) is a joint initiative between ANZ and Visa.

eftpos Secure is a joint initiative between ANZ and eftpos.

These offer you protection against the unauthorised use of your ANZ Access Visa Debit card for online shopping at participating Visa Secure (formerly known as Verified by Visa) or eftpos Secure online merchants. At these merchants, Visa Secure (formerly known as Verified by Visa) and eftpos Secure allow you to identify yourself using your Visa Secure (formerly known as Verified by Visa) or eftpos Secure One Time Password.

If there are multiple cardholders, all cardholders will be auto enrolled into Visa Secure (formerly known as Verified by Visa) and eftpos Secure in order to shop online with the Visa Secure (formerly known as Verified by Visa) or eftpos Secure protection at participating merchants.

You can call ANZ on 13 13 14 for further assistance.

Any advice does not take into account your personal needs and financial circumstances and you should consider whether it is appropriate for you. ANZ recommends you read the Terms and Conditions and Product Disclosure Statement, which are available at anz.com or by calling 13 13 14, before deciding whether to acquire, or continue to hold, the product.

™ ANZ Falcon is a trademark of Australia and New Zealand Banking Group Limited (ANZ) ABN 11 005 357 522. Falcon is a trademark of Fair Isaac Corporation.

® Registered to BPAY Pty Ltd ABN 69 079 137 518

Eligibility criteria apply to the issue of ANZ Access Visa Debit card.

Return