-

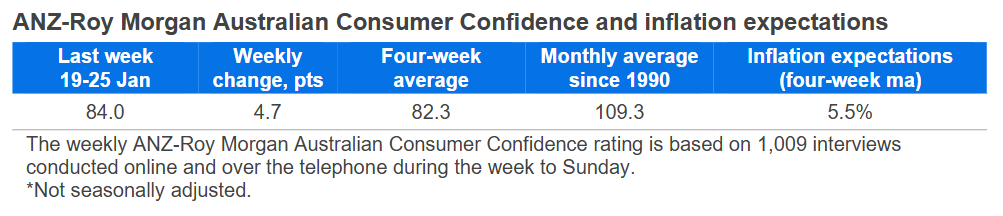

Consumer confidence rose 4.7 points last week to 84.0 points. The four-week moving average ticked up 0.1 points to 82.3 points.

‘Weekly inflation expectations’ dropped 0.2 percentage point to 5.4 per cent, while the four-week moving average eased from 5.6 per cent to 5.5 per cent.

‘Current financial conditions’ (over the last year) jumped 8.8 points, while ‘future financial conditions’ (next 12 months) lifted 0.2 points.

‘Short-term economic confidence’ (next 12 months) climbed 7.0pts, and ‘medium-term economic confidence’ (next five years) was up 2.6 points.

The ‘time to buy a major household item’ subindex increased 4.9 points.

"Consumer Confidence rose 4.7 points to 84.0 points last week though it remains below the 2025 average (86.3 points)," ANZ Economist, Sophia Angala said.

"Last week’s improvement was driven by improving household confidence in their current finances and economic conditions over the next year, likely supported by strong labour market data. ‘Weekly inflation expectations’ dropped ahead of this week’s Q4 2025 CPI release. We forecast a 0.8% q/q increase in trimmed mean inflation in Q4, which should see the RBA keep the cash rate on hold at 3.60% at its February meeting."

For media enquiries contact:

Siobhan Jordan

Senior External Communications Manager

Tel: +61 403 988 326

anzcomau:newsroom/mediacentre/ANZ-Roy-Morgan-Consumer-Confidence

Consumer confidence slightly improves

2026-01-28

/content/dam/anzcomau/mediacentre/images/consumerconfidence/ImagesTiles/colourful clothes.jpg