-

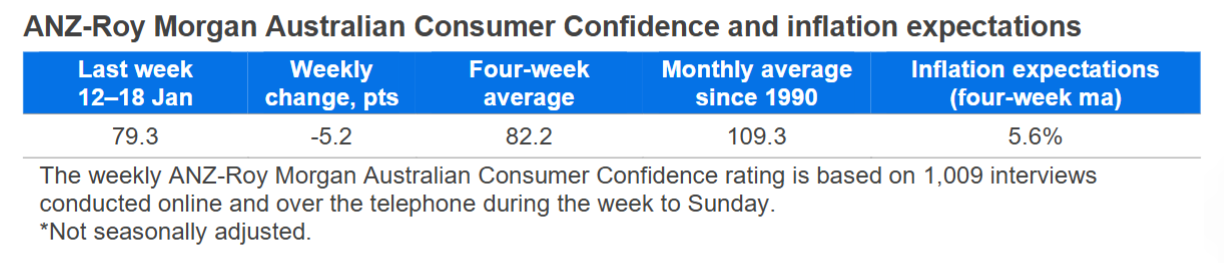

Consumer confidence dropped 5.2 points last week to 79.3 points. The four-week moving average fell 1.6 points to 82.2 points.

‘Weekly inflation expectations’ lifted 0.2 percentage point to 5.6 per cent, while the four-week moving average was unchanged at 5.6 per cent.

‘Current financial conditions’ (over the last year) eased 2.0 points, while ‘future financial conditions’ (next 12 months) declined 2.1 points.

‘Short-term economic confidence’ (next 12 months) decreased 6.1 points, and ‘medium-term economic confidence’ (next five years) was down 3.5 points.

The ‘time to buy a major household item’ subindex plunged 12.3 points.

"Consumer Confidence declined 5.2 points last week to 79.3 points. This was the sharpest weekly drop in confidence since February 2023 (when the RBA increased the cash rate to 3.35 per cent)," ANZ Economist, Sophia Angala said.

"Consumer confidence, which saw some improvement following Stage 3 tax cuts introduced in July 2024, has now plummeted to its lowest level since the tax cuts.

"The ‘time to buy a major household item’ subindex eased to its lowest level since late April 2025. This pullback follows an upward trend over the second half of 2025, supported by sales events and moderating inflation.

"Household confidence in the five-year economic outlook dropped to its weakest level in over two decades, perhaps impacted by the possibility of rate hikes in 2026. While we expect the RBA to be on an extended hold in 2026, we consider the risks of a rate hike in the first half of this year have risen."

For media enquiries contact:

Siobhan Jordan

Senior External Communications Manager

Tel: +61 403 988 326

anzcomau:newsroom/mediacentre/ANZ-Roy-Morgan-Consumer-Confidence

Consumer confidence hits 18 month low

2026-01-20

/content/dam/anzcomau/mediacentre/images/consumerconfidence/ImagesTiles/Consumer Confidence.png