-

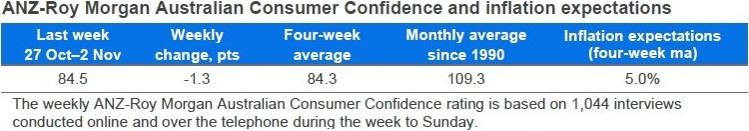

- Consumer confidence fell 1.3pts last week to 84.5pts. The four-week moving average ticked down 0.1pts to 84.3pts.

- ‘Weekly inflation expectations’ lifted 0.4ppt to 5.2 per cent, while the four-week moving average was at 5.0 per cent.

- ‘Current financial conditions’ (over the last year) decreased 0.3pts, while ‘future financial conditions’ (next 12 months) declined 3.9pts.

- ‘Short-term economic confidence’ (next 12 months) eased 3.2pts, and ‘medium-term economic confidence’ (next five years) increased 2.4pts.

- The ‘time to buy a major household item’ subindex was down 1.4pts.

ANZ Economist, Sophia Angala said: "Last week’s Q3 CPI print pointed to a stalling in annual disinflation and likely supported the jump in ‘Weekly inflation expectations’ of 0.4ppt. The trimmed mean result of 3.0% is likely to lead to a hold from the RBA in November, which may be pulling down confidence in household future financial conditions. ANZ Research expects the RBA to hold the cash rate at 3.60% at its meeting today, and expects the final 25bp rate cut in H1 2026. ANZ-Roy Morgan Australian Consumer Confidence has been trending down recently across all housing cohorts, with renters currently facing the lowest confidence levels. This is in contrast to the rate hiking period, when homeowners with mortgages had the lowest average confidence level."

For media enquries contact:

Siobhan Jordan

Senior External Communications Manager

+61 403 988 326

anzcomau:newsroom/mediacentre/ANZ-Roy-Morgan-Consumer-Confidence

Inflation expectations up

2025-11-04

/content/dam/anzcomau/mediacentre/images/consumerconfidence/ImagesTiles/Consumer Confidence.png