-

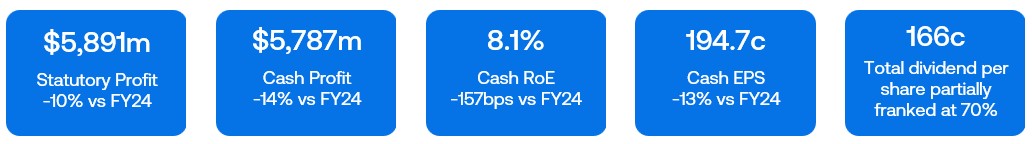

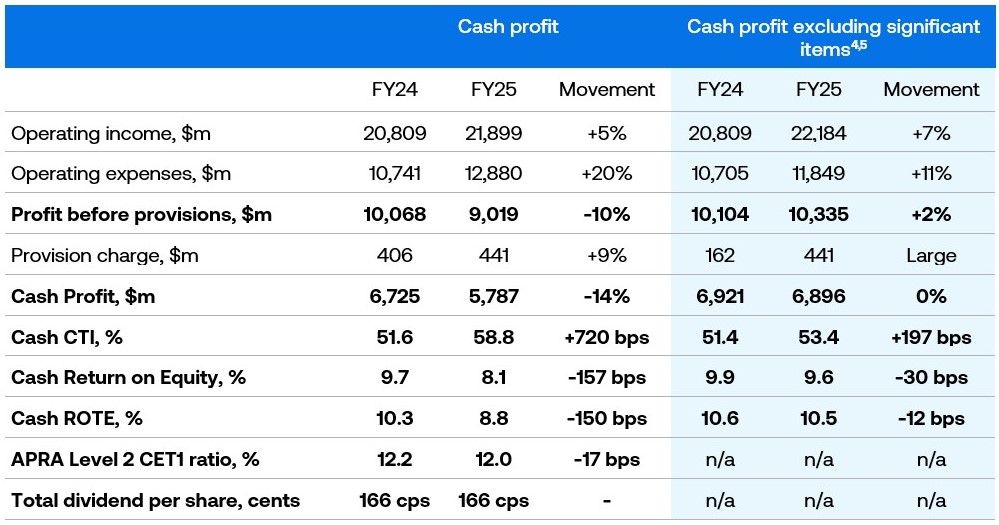

- ANZ today announced a Statutory Profit for the full year ended 30 September 2025 of $5,891 million, down 10% on the prior year, and a Cash Profit[1] of $5,787 million. ANZ’s Common Equity Tier 1 Ratio was 12.0%, Cash Return on Equity 8.1% and Cash Return on Tangible Equity 8.8%.

- Excluding significant items totalling $1,109 million as announced on 31 October 2025,[2] including ASIC settlement and restructuring charges, Cash Profit was flat on the prior year[3] at $6,896 million, while Cash Return on Equity was 9.6% and Cash Return on Tangible Equity 10.5%.

- The proposed Final Dividend is 83 cents per share, for a total full year dividend of 166 cents, partially franked at 70%.

Overview of financial performance

CEO commentary

ANZ Chief Executive Officer Nuno Matos said: “Today’s results highlight three things. First, our franchise has a strong competitive position. We have two scale markets, Australia and New Zealand, two market leading positions, our Institutional and New Zealand businesses, and a well-diversified business benefitting from our strong presence in Asia, the fastest growing economic region in the world.

“Second, we have a significant opportunity to improve our performance in Australia Retail and Business & Private Bank, while extending our leadership in Institutional and New Zealand.

“Third, ANZ 2030 is the right strategy to capture these opportunities.

“Our full year statutory profit of $5.89 billion was down 10% on the previous year’s performance, impacted by significant items of $1.1 billion as we resolved long-standing regulatory investigations, and actions taken to simplify our business. While our financial performance held steady when excluding these items, our performance as a business reinforces the importance of our ANZ 2030 strategy.

“Looking at our four main divisions, Institutional and New Zealand have performed consistently well, however Australia Retail and Business & Private Bank have underperformed. Despite growth in both assets and deposits, intense competition and a falling interest rate environment impacted margins.

“We have maintained a strong focus on the fundamentals of our balance sheet, capital, provisioning, and the composition of our business. A final dividend of 83 cents per share reflects the underlying financial performance of the business and our confidence in our strategy.

“We continue to make progress on our immediate priorities at pace, including embedding our leadership team and our culture reset, accelerating the integration of Suncorp Bank, delivering the ANZ Plus single-customer front-end, simplifying the bank and reducing duplication, and improving non-financial risk management.

“Our strong capital position enables us to deliver on our immediate priorities to ensure we get the basics right, including a substantial improvement in productivity and initial investment for the bank’s growth.

“Uplifting our non-financial risk management is a key priority. A significant amount of work is already underway to support the business and cultural transformation which will deliver a better-run bank for our customers. The Root Cause Remediation Plan we submitted to the Australian Prudential Regulation Authority has now been approved.

“Today we also provide an updated approach to our reporting, including providing transparency around our key performance indicators and a more detailed scorecard. We are committed to providing these details on an ongoing basis, as we demonstrate our commitment to our strategy and ambitions.

“The results we have announced today demonstrate our franchise is strong, but action is needed. We are absolutely committed to executing ANZ 2030 and are on the right path. As we deliver our strategy, we will accelerate growth and outperform the market, while delivering more for our customers,” Mr Matos concluded.

Credit quality

The total credit impairment charge for the full year was $441 million, comprising:

- a collectively assessed provision (CP) charge of $114 million; and

- an individually assessed provision (IP) charge of $327 million.

Overall credit quality has remained sound, with a modest increase in individual provisions over the half, primarily driven by lower write-backs and recoveries.

The resulting collective provision balance post foreign exchange movements was $4.38 billion, with the collective provision coverage rate[1] increasing 5 basis points to 1.18% over the half.

Dividend & capital

ANZ Bank Group’s capital position continues to remain strong, with a Common Equity Tier 1 ratio of 12.03% which is an increase of 25 basis points over the half.

The Board has proposed a 2025 Final Dividend of 83 cents per share, partially franked at 70%, which remains unchanged from the first half.

As ANZ previously announced:

- a 1.5% discount has been applied to the Dividend Reinvestment Plan and Bonus Option Plan for the 2025 Final Dividend; and

- ANZ ceased its remaining ~$800 million of its on-market share buy-back and will return surplus capital of ~$1 billion from its Non-Operating Holding Company to the Bank. Inclusive of this capital our proforma CET1 ratio is 12.26%.

Tracking our Progress for ANZ 2030

Interviews with relevant executives, including Nuno Matos, can be found at anz.com.au/bluenotes

For media enquiries contact

Lachlan McNaughton

Head of Media Relations

+61 457 494 414Alexandra Cooper

Media Relations Manager

+61 481 464 230For analyst enquiries contact

Kylie Bundrock

Group General Manager, Investor Relations and M&A

+61 403 738 809Cameron Davis

Executive Manager Investor Relations

+61 421 613 819Approved for distribution by the ANZ Group Holdings Limited Board

[1] Cash Profit excludes non-core items included in statutory profit outlined in the FY25 ANZGHL Results Announcement. It is provided to assist readers in understanding the result of the ongoing business activities of the Group.

[2] Details of these significant items are outlined on page 14 of the FY25 ANZGHL Results Announcement. The significant items reduced cash profit by $1,109 million comprising a reduction to income of $285 million, increased expenses of $1,031 million and reduced tax expense of $207 million.

[3] FY24 significant items relate to Suncorp Bank acquisition related adjustments with details outlined in the FY24 ANZGHL Results Announcement.

[4] Details of the 2025 significant items are outlined on page 14 of the FY25 ANZGHL Results Announcement.

[5] Details of the 2024 significant items are outlined on page 10 of the FY25 ANZGHL Results Announcement and relates to 2024 Suncorp Bank acquisition related adjustment.

[6] Collectively assessed provision as a % of credit RWA.

Important Information

This page contains general background information about the ANZ Group’s activities current as at 9 November 2025. It is information given in summary form and does not purport to be complete.

It is not intended to be and should not be relied upon as advice to investors or potential investors, and does not take into account the investment objectives, financial situation or needs of any particular investor. These should be considered, with or without professional advice, when deciding if an investment is appropriate.

This page contains certain forward-looking statements or opinions including statements regarding our intent, belief or current expectations with respect to the ANZ Group’s business operations, market conditions, results of operations and financial condition, capital adequacy, sustainability objectives or targets, specific provisions and risk management practices. When used in this page, the words ‘forecast’, ‘estimate’, 'goal', 'target', 'indicator', 'plan', 'pathway', ‘ambition’, ‘modelling’, ‘project’, ‘intend’, ‘anticipate’, ‘believe’, ‘expect’, ‘may’, ‘probability’, ‘risk’, ‘will’, ‘seek’, ‘would’, ‘could’, ‘should’ and similar expressions, as they relate to the ANZ Group and its management, are intended to identify forward-looking statements or opinions. Forward-looking statements or opinions may also be otherwise included in this page. Those statements are usually predictive in character; or may be affected by inaccurate assumptions or unknown risks and uncertainties or other factors, many of which are beyond the control of the ANZ Group or may not be known to the ANZ Group at the time of the preparation of the ANZ 2030 strategy, such as general global economic conditions, external exchange rates, competition in the markets in which the ANZ Group will operate, and the regulatory environment. Each of these statements and related actions is subject to a range of assumptions and contingencies, including the actions of third parties. As such, these statements should not be relied upon when making investment decisions.

These statements only speak as at the date of publication and no representation is made as to their correctness on or after this date. Forward-looking statements constitute ‘forward-looking statements’ for the purposes of the United States Private Securities Litigation Reform Act of 1995. No member of the ANZ Group undertakes any obligation to publicly release the result of any revisions to these forward-looking statements to reflect events or circumstances after the date hereof to reflect the occurrence of unanticipated events.

There can be no assurance that actual outcomes will not differ materially from any forward-looking statements or opinions contained herein.

Unless otherwise indicated, all market share information in this page is based on management estimates having regard to internally available information, all amounts in this page are in Australian dollars, and all financial performance metrics are on a cash profit basis. Sum of parts within charts and commentary may not equal totals due to rounding.

anzcomau:newsroom/mediacentre/Media-Release

2025 Full Year Result & Proposed Final Dividend

2025-11-10

/content/dam/anzcomau/mediacentre/images/gallery/ANZ Centre, night view.jpg