Fraud protection.

Now it's personal.

ANZ Falcon® technology monitors millions of transactions every day to help keep you safe from fraud.

Falcon® is a registered trademark of Fair Issac Corporation.

Choosing a credit card shouldn't take precious time away from your business, which is why we have four cards for you to pick from.

Each card boasts unique features that pack a punch. Below you'll find points on offer, interest-free periods on purchases, even a low rate card that gets the job done.

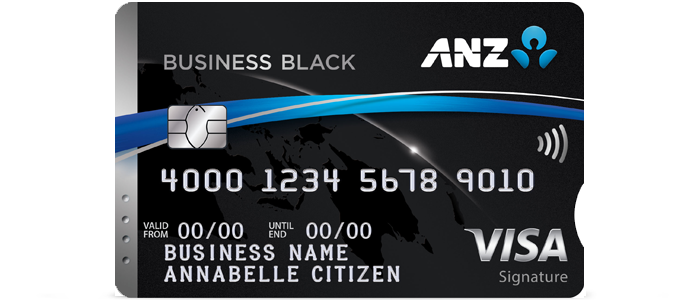

ANZ has been awarded Canstar’s Outstanding Value Frequent Flyer Business Credit Cards for 2025, with the ANZ Business Black and ANZ Qantas Business Rewards cards recognised for their uncapped points earning potential, leading card features and competitive costs.

When you spend $6k in the first 3 months from approval and keep your card for over 15 months from activation.disclaimer

T&Cs, eligibility criteria, fees and charges apply (including an Annual Fee, currently $300 plus a Rewards Fee, currently $75 per card per year). New cardholders only. Offer not available to customers who have held an ANZ Qantas Business Rewards or ANZ Business Black card in the last 12 months.

Earn up to 150,000 bonus Qantas Points with a new ANZ Qantas Business Rewards card. Earn 100,000 points when $6k spent in first 3 months from approval + earn 50,000 when card kept over 15 months from activation.disclaimer

Earn up to 150,000 extra Business Rewards points with a new ANZ Business Black card. Earn 100,000 points when $6k spent within 3 months from approval + earn 50,000 when card kept over 15 months from activation.disclaimer

Save $150 with no Annual Feedisclaimer for the first year on a new card.

Save $100 with no Annual Feedisclaimer for the first year on a new card.

You can now apply online to increase your business credit card account limit via ANZ GoBiz.

Get conditional approval in 20 minutes, if eligible.

Maximum total account credit limit of $50,000 allowed via ANZ GoBiz.

You can now increase or decrease the limit of an existing cardholder or the credit limit on an existing business credit card account by either calling your Relationship Manager or the number below.

You can apply for credit limits over $50,000 with a business banking specialist.

Mon-Fri 8am to 6pm (Sydney/Melbourne time)

We're here to help you with your ANZ business credit cards

Our aim is to make ANZ products and services more accessible and inclusive.

If you’re experiencing vulnerability or having trouble making repayments on your loan or credit card, get in touch and together we can work on a plan to get you back on track.

Any advice does not take into account your personal needs, financial circumstances or objectives and you should consider whether it is appropriate for you.

ANZ recommends you read the applicable Terms and Conditions and the ANZ Financial Services Guide (PDF) before acquiring the product.

Products are available to approved applicants for business purposes only. All applications for credit are subject to ANZ's normal credit approval criteria. Terms and conditions, Fees and charges and eligibility criteria apply.

We recommend you obtain independent advice from a financial planner and registered tax agent if you are considering whether these products are right for you.

ANZ Commercial Card (ANZ Business One) Terms and Conditions (PDF) and ANZ Commercial Card (ANZ Business One) Fees and Charges (PDF) apply.

Offer available to new and approved applicants who apply for a new ANZ Qantas Business Rewards account. ANZ may terminate, withdraw or vary this offer at any time without prior notice. This offer applies only once per new ANZ Qantas Business Rewards account. Offer is not available when transferring from an existing ANZ Business credit card account and/or adding an additional account to an existing ANZ Business credit card contract. You are not eligible for this offer if you currently hold or have held an ANZ Qantas Business Rewards and/or ANZ Business Black account in the last 12 months. Your application must be approved, and you must activate your ANZ Qantas Business Rewards account and make $6,000 worth of eligible purchases within 3 months of approval to receive the 100,000 bonus Qantas Points. Eligible purchases means purchases which are eligible to earn Qantas Points. Certain transactions and other items are not eligible to earn Qantas Points. For details refer to the ANZ Qantas Business Rewards Terms & Conditions (PDF). The 100,000 bonus Qantas Points will be credited to the Qantas Business Rewards member account within 3 months of the eligible spend criteria being met. The 50,000 bonus Qantas Points for retaining the card over 15 months will be credited to the Qantas Business Rewards member account within 3 months of you retaining the card for over 15 months from card activation. If you transfer or cancel your new ANZ Qantas Business Rewards account before the bonus Qantas Points are processed to your Qantas Business Rewards member account, you may become ineligible for this offer. If any repayments are overdue before the bonus Qantas Points are processed to your membership, you will be ineligible for this offer until any overdue amount and amounts shown on your statement as being payable immediately have been paid.

ReturnQantas Points and Bonus Qantas Points are earned in accordance with the ANZ Qantas Business Rewards Terms & Conditions. Certain transactions and other items are not eligible to earn Qantas Points, for details refer to the ANZ Qantas Business Rewards Terms & Conditions. The Principal must be a member of the Qantas Business Rewards Program to earn Qantas Points in connection with the ANZ Qantas Business Rewards Card. All Qantas Points earned on eligible Card spend will be awarded to the Principal. Points will not be awarded to individual Cardholders.

ReturnInterest free days do not apply if you do not pay your Closing Balance in full by the due date each month. Payments to your account are applied in the order set out in the ANZ Commercial Card (ANZ Business One) Terms and Conditions (PDF).

ReturnReward Points and Bonus Reward Points accrue in accordance with the ANZ Business Rewards Program Terms and Conditions (PDF). Certain transactions and other items are not eligible to earn Reward Points. For details refer to the Business Rewards Program Terms and Conditions (PDF).

ReturnOffer available to new and approved applicants who apply for a new ANZ Business Black account. ANZ may terminate, withdraw or vary this offer at any time without prior notice. This offer applies only once per new ANZ Business Black account. Offer is not available when transferring from an existing ANZ Business credit card account and/or adding additional account to an existing ANZ Business credit card contract. You are not eligible for this offer if you currently hold or have held an ANZ Qantas Business Rewards and/or ANZ Business Black account in the last 12 months. Your application must be approved, and you must activate your ANZ Business Black account and make $6,000 worth of eligible purchases within 3 months of approval to receive the 100,000 extra Reward Points. Eligible purchases means purchases which are eligible to earn Reward Points. Certain transactions and other items are not eligible to earn Reward Points. For details refer to the ANZ Business Rewards Program Terms and Conditions (PDF). The 100,000 extra Reward Points will be credited to the Principal within 3 months of the eligible spend criteria being met. The 50,000 extra Rewards Points for retaining the card for over 15 months will be credited to the Principal within 3 months of you retaining the card for over 15 months from card activation. If you transfer or cancel your new ANZ Business Black account before the extra Reward Points are processed to your account, you may become ineligible for this offer. If any repayments are overdue before the relevant extra Reward points are processed to your account, you will be ineligible for this offer until any overdue amount and amounts shown on your statement as being payable immediately have been paid.

ReturnOffer available to new and approved applicants who apply for a new ANZ Business 55 Interest Free Days and/or ANZ Business Low Rate credit card account. ANZ may terminate or withdraw this offer at any time without prior notice. The Annual Fee offer applies only once per new ANZ Business 55 Interest Free Days and/or ANZ Business Low Rate credit card account. Offer is not available when transferring from an existing ANZ Business credit card account. The Annual Fee waiver is applicable for one year subsequent to the date you accept the ANZ Commercial Card (ANZ Business One) Terms and Conditions (PDF) in respect of the new ANZ Business 55 Interest Free Days and/or ANZ Business Low Rate credit card account. In subsequent years the Annual Fee (currently $150 for an ANZ Business 55 Interest Free Days account and $100 for an ANZ Business Low Rate account but is subject to change) will apply.

Return