Fraud protection.

Now it's personal.

ANZ Falcon® technology monitors millions of transactions every day to help keep you safe from fraud.

Falcon® is a registered trademark of Fair Issac Corporation.

Fraud protection.

Now it's personal.

ANZ Falcon® technology monitors millions of transactions every day to help keep you safe from fraud.

Falcon® is a registered trademark of Fair Issac Corporation.

Fraud protection.

Now it’s personal.

ANZ Falcon® technology monitors millions of transactions every day to help keep you safe from fraud.

Falcon® is a registered trademark of Fair Isaac Corporation.

Get up to speed with cyber threats, scams and other important online risks that occurred over the last year.

For more recent security alerts from the last two months, please see our latest scams, fraud and security alerts.

![]()

Type:

The ASD's ACSC has published a critical alert regarding vulnerabilities within Australia impacting Cisco ASA 5500-X Series models, that are running Cisco ASA Software or FTD software:

A number of versions of Cisco software releases are affected, including those within the following ranges:

ASD’s ACSC encourages Australian organisations should consult the below for investigation and remediation advice:

https://sec.cloudapps.cisco.com/security/center/resources/asa_ftd_continued_attacks

Affected organisations should investigate and monitor connected environments for potential malicious activity.

For more information, please read the Australian Cyber Security Centre’s alert, Multiple vulnerabilities affecting Cisco ASA 5500-X Series devices | Cyber.gov.au

Type:

The ASD's ACSC has published a high alert regarding increased targeting of online code repositories.

Threat actors have been observed gaining access to online code repositories and have been noted to do the following after gaining access to privileged systems and accounts:

This access provides threat actors a better understanding of internal processes and systems, increasing an organisation’s attack surface and enabling future, novel attacks.

ASD’s ACSC advises organisations to:

Organisations that have been impacted or require assistance can contact ACSC via 1300 CYBER1 (1300 292 371).

For more information, please read the Australian Cyber Security Centre’s alert, Ongoing targeting of online code repositories.

Type:

The ASD's ACSC has published a critical alert regarding vulnerabilities affecting SonicWall SSL VPNs in Australia (CVE-2024-40766)

According to the ASD’s ACSC, the vulnerability can result in Akira ransomware targeting vulnerable Australian organisations through SonicWall SSL VPNs.

The vulnerability enables an attacker to achieve unauthorised access and in specific conditions causes the firewall to crash. The vulnerability affects the following SonicWall devices:

ASD’s ACSC encourages Australian organisations should review their use of vulnerable SonicWall devices, and consult the below for investigation and remediation advice:

The vendor has also urged organisations to change passwords after updating to the latest version.

Organisations remain vulnerable if they have not fully implemented the mitigation advice by updating credentials after updating the firmware.

For more information, please read the Australian Cyber Security Centre’s alert, Ongoing active exploitation of SonicWall SSL VPNs in Australia (CVE-2024-40766) | Cyber.gov.au

Posted on 01 September 2025

Type:

The ASD's ACSC has published an alert regarding multiple vulnerabilities impacting NetScaler ADC (formerly Citrix ADC) and NetScaler Gateway (formerly Citrix Gateway) products:

Citrix reports active exploitation of these vulnerabilities has been observed.

Australian organisations should review their networks for use of vulnerable instances of NetScaler ADC and NetScaler Gateway.

Organisations or individuals that have been impacted or require assistance can contact ACSC via 1300 CYBER1 (1300 292 371).

For more information, please read the Australian Cyber Security Centre’s alert: Multiple vulnerabilities affecting NetScaler ADC and NetScaler Gateway devices

Type:

We have seen an increase of cyber criminals gaining unauthorised access to data stored in customer relationship management (CRM) systems through social engineering.

Social engineering is a tactic used by cyber criminals to extract sensitive information, often via social media or phone calls (“vishing”). This data may be used to impersonate employees or vendors to gain access to company information or systems. Attackers typically exploit emotions like fear, urgency, or excitement to pressure individuals into bypassing standard procedures. If a communication seems suspicious or asks for unusual actions, avoid sharing information, uphold business security protocols, and end the interaction immediately.

Businesses are encouraged to stay vigilant against suspicious communications across email, phone, messaging apps, and social media. Here are some practical ways to help safeguard your business:

If you suspect fraud on your account, have shared financial information or transferred money as a result of this scam, please contact us straightaway.

You can also report scams to the Australian Government’s Scamwatch and the Australian Cyber Security Centre’s ReportCyber.

Posted on 21 July 2025

Type:

The ASD's ACSC has published a critical alert regarding vulnerabilities affecting Microsoft Office SharePoint Server products (CVE-2025-53770).

According to the ASD’s ACSC, the vulnerability may allow an unauthorised attacker to execute code over a network.

ASD’s ACSC encourages Australian organisations to:

For more information, please read the Australian Cyber Security Centre’s alert, Vulnerability in Microsoft Office SharePoint Server products.

Posted on 16 July 2025

Type:

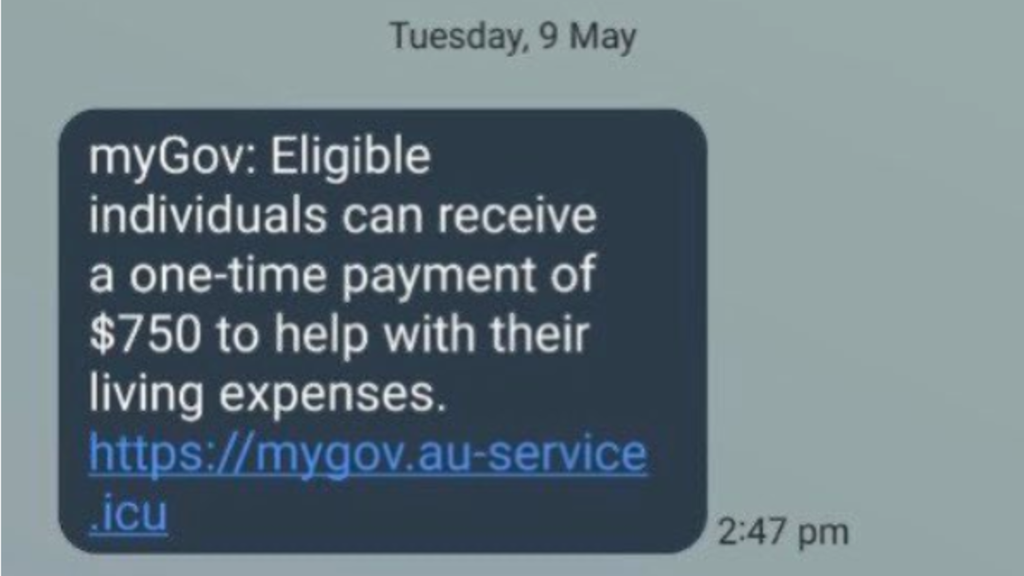

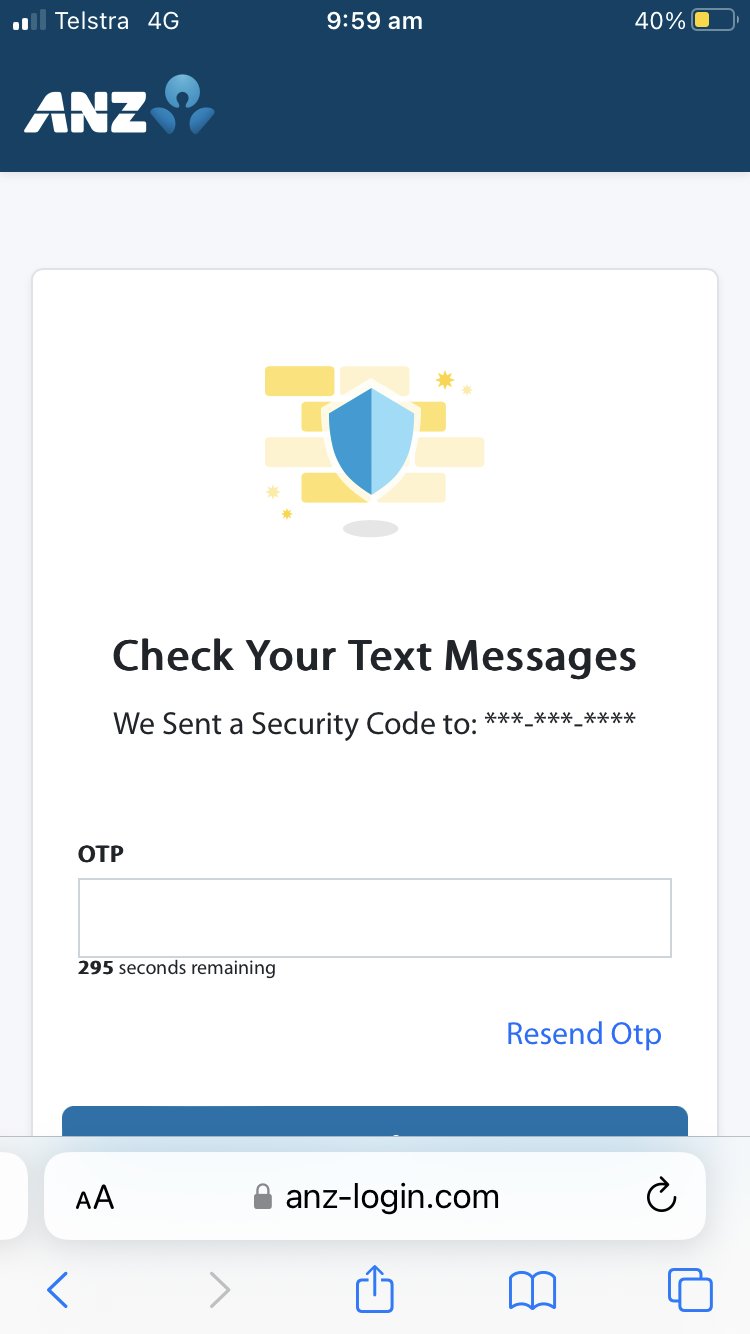

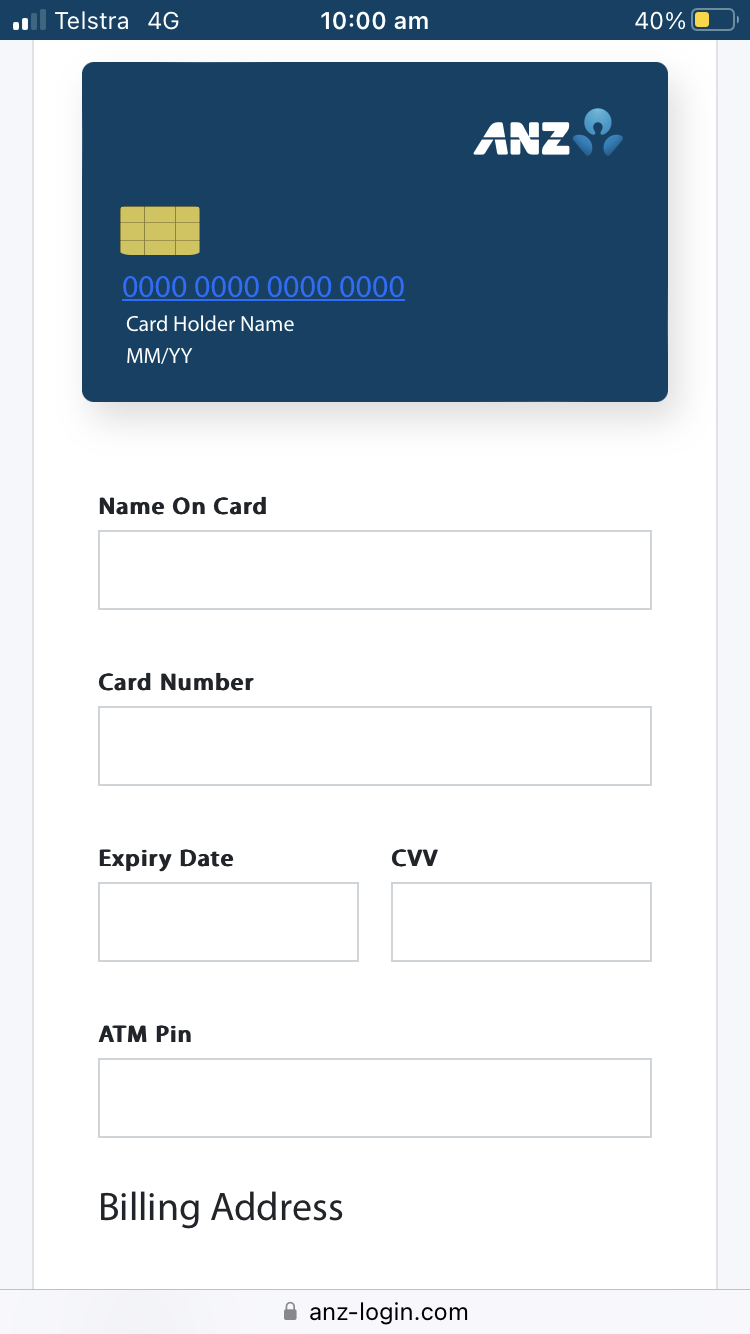

We would like to remind our customers to be wary of scams involving digital wallets.

Digital wallets allow you to make transactions with your mobile or wearable device instead of a physical card.

While digital wallets are safe, if scammers have access to your card details and one-time passcodes (OTP), they can add your card to their own device (or third party) and spend or withdraw your money without your permission.

If you suspect fraud on your account or have shared financial information or transferred money as a result of this scam, please contact us straightaway. Our Customer Protection Team is available 24/7 to help you.

You can also report scams to the Australian Government’s Scamwatch and the Australian Cyber Security Centre’s ReportCyber.

Type:

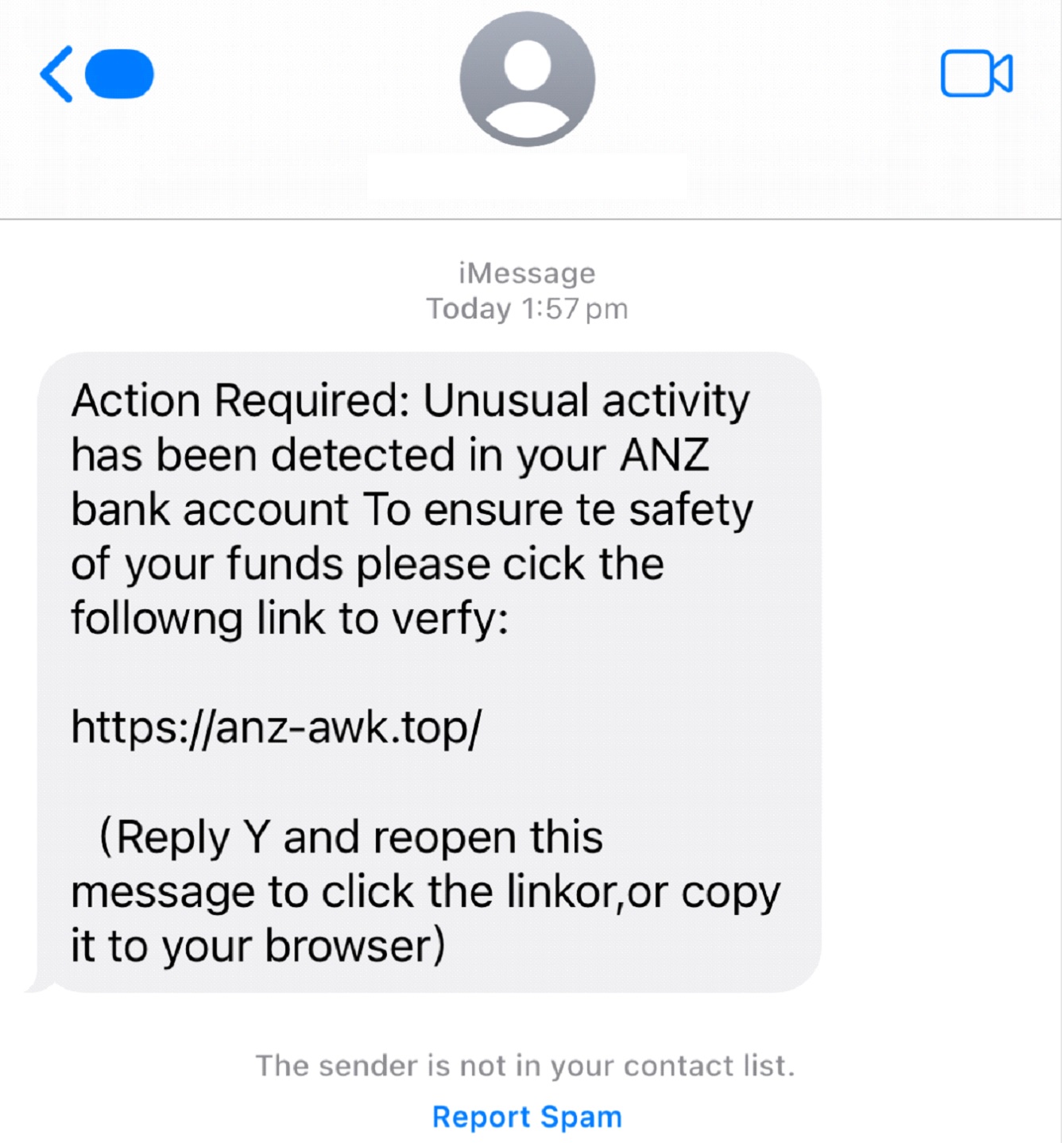

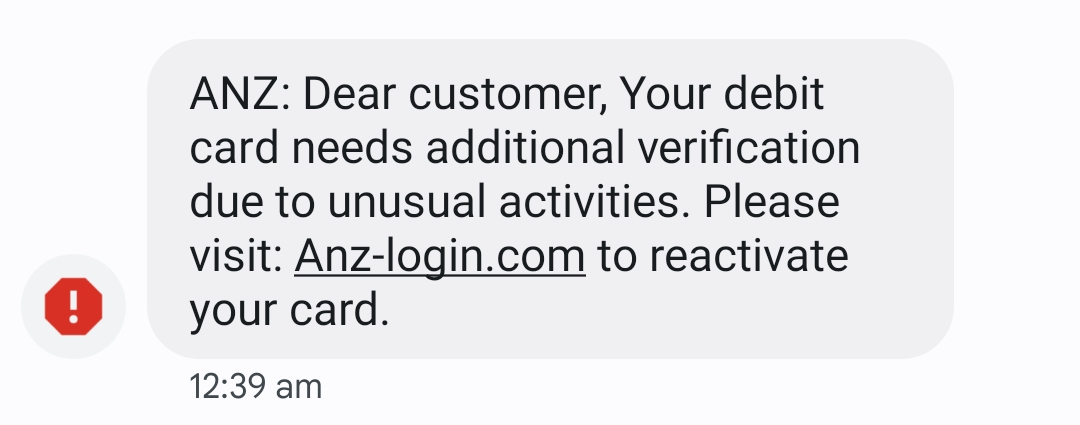

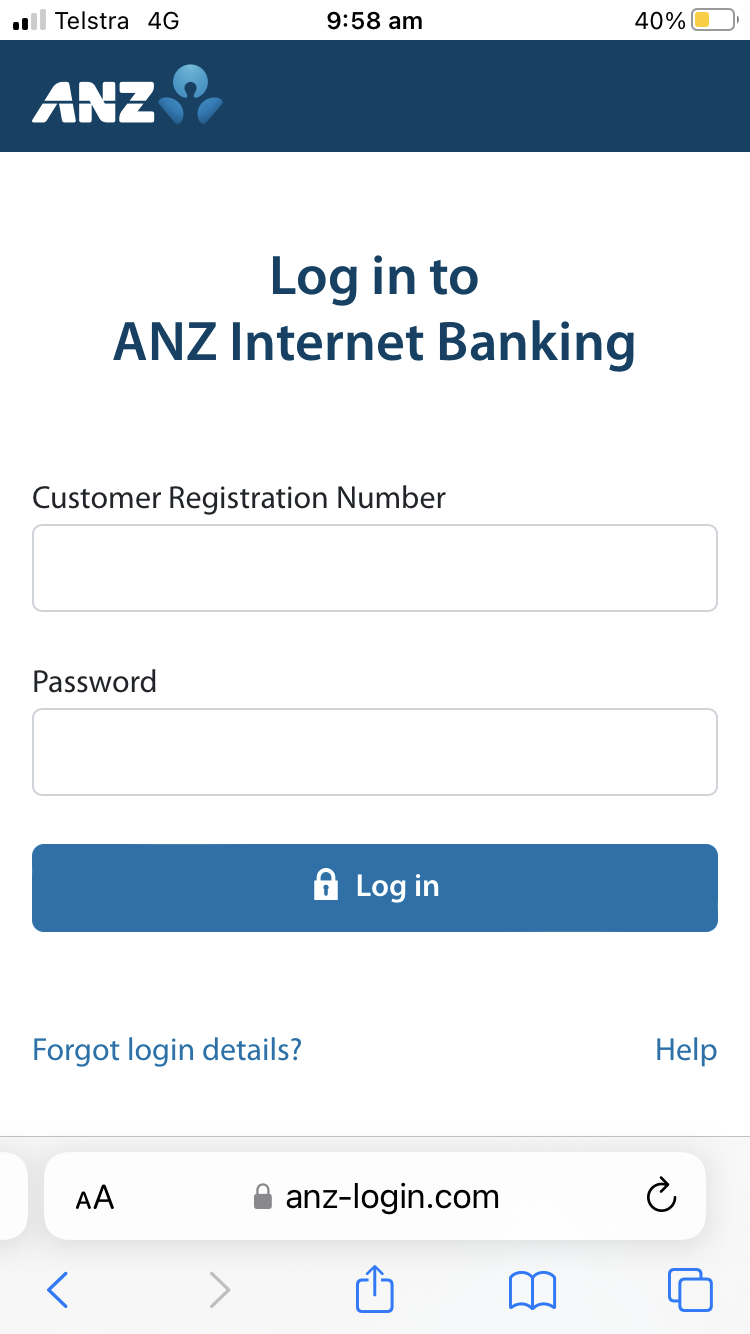

We have been made aware of an increase in bank impersonation scams. Be cautious of SMS messages or phone calls, claiming to be from ANZ. They may ask you to transfer money, open another account, provide your sensitive banking details or click on a link.

Remember, we will never ask you to:

Impersonation scams imitate not only banks, but government agencies, organisations and even friends or family members. Here are some tips to help you protect yourself:

For more information about bank impersonation scams, visit ANZ Security Hub – types of scams – bank impersonation scams.

If you suspect fraud on your account or have shared financial information or transferred money as a result of this scam, please contact us straightaway. Our Customer Protection Team is available 24/7 to help you.

You can also report scams to the Australian Government’s Scamwatch and the Australian Cyber Security Centre’s ReportCyber.

Posted on 10 July 2025

Type:

The ASD's ACSC has published an alert regarding 2 vulnerabilities affecting Citrix Netscaler ADC and NetScaler Gateway Products.

The following vulnerabilities have been identified:

According to the ASD’s ACSC, these vulnerabilities can lead to memory overflow issues, resulting in unintended control flow and Denial of Service due to insufficient input validation.

ASD’s ACSC encourages Australian businesses, organisations and government entities to:

For more information, please read the Australian Cyber Security Centre’s alert, Critical vulnerabilities in Citrix Netscaler ADC and NetScaler Gateway Products.

Type:

Although cheque usage is less common today, there are still instances where fraudsters deposit fake cheques into ATMs as part of schemes targeting individuals selling goods.

In these scenarios, a fake cheque is deposited into the seller’s account which may temporarily make it appear that funds have been received. However, the cheque has not actually cleared. This can lead the seller to believe the payment is valid and release the goods, only to later discover that the cheque was dishonoured.

If you suspect fraud on your account or have shared financial information or transferred money as a result of this scam, please contact us straightaway. Our Customer Protection Team is available 24/7 to help you.

You can also report scams to the Australian Government’s Scamwatch and the Australian Cyber Security Centre’s ReportCyber.

Posted on 23 June 2025

Type:

The ASD's ACSC has sent a critical alert relevant to Australian organisations using Citrix Netscaler ADC and NetScaler Gateway Products (CVE-2025-5349 and CVE-2025-5777).

Citrix has identified the following vulnerabilities affecting Netscaler ADC and NetScaler Gateway Products:

Australian organisations should review their networks for use of vulnerable instances of the NetScaler ADC and NetScaler Gateway products and consult Citrix's customer advisory Citrix Security Advisory for mitigation advice.

For more information, please read the Australian Cyber Security Centre’s alert: Critical vulnerabilities in Citrix Netscaler ADC and NetScaler Gateway Products

Type:

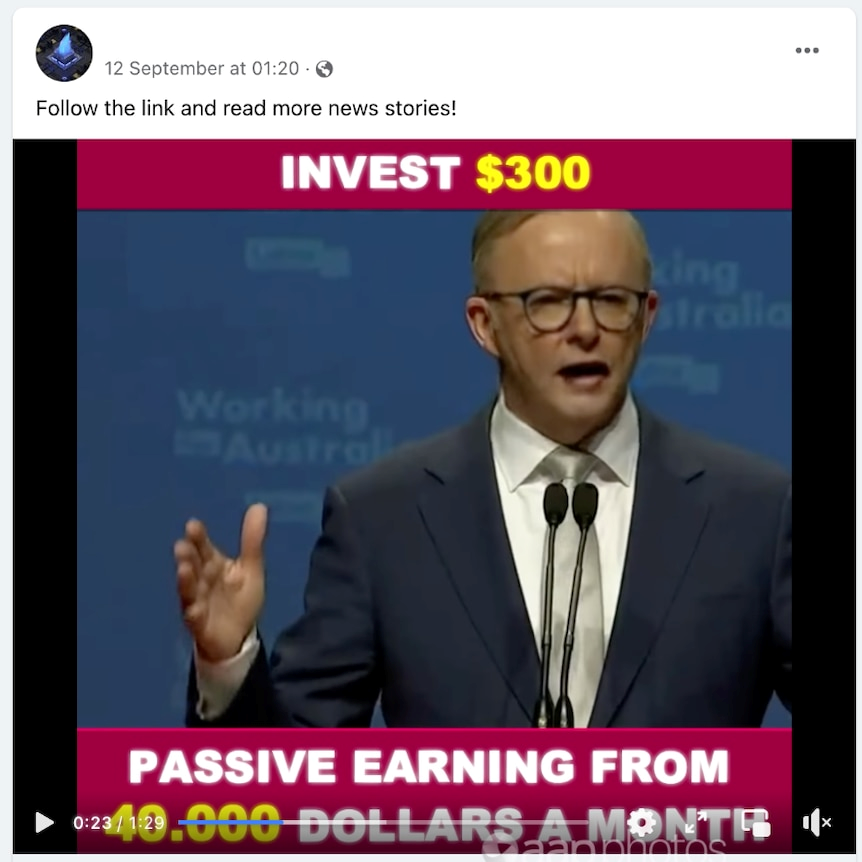

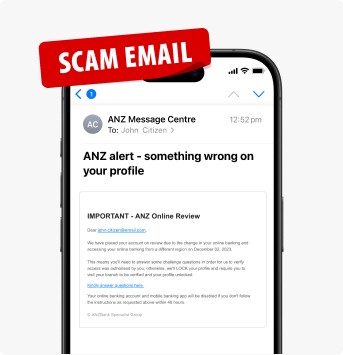

Investment scams are on the rise, and they’re becoming more convincing than ever. Many of these scams begin with ads on social media that appear to be endorsed by well-known and trusted public figures.

Once you engage, the scammer may introduce what sounds like an incredible opportunity to grow your money —often promising returns that are far higher than what you’d expect from a genuine investment. Sometimes, though, the offer might only seem slightly better than what you're currently getting, making it even more convincing and harder to detect.

Here’s what to look out for:

For more information visit, What is an investment scam, and how can you protect yourself?

If you suspect fraud on your account or have shared financial information or transferred money as a result of this scam, please contact us straightaway. Our Customer Protection Team is available 24/7 to help you.

You can also report scams to the Australian Government’s Scamwatch and the Australian Signals Directorate’s ReportCyber portal.

Screenshot from a social media platform showing a scam message promoting unrealistic investment returns.

![]()

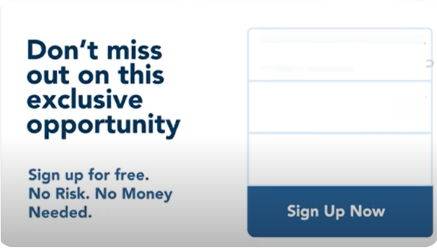

Screenshot from a social media platform advertising a false investment scheme.

![]()

Screenshot from US Securities and Exchange Commission showing a message of a sign up page of an investment platform.

Type:

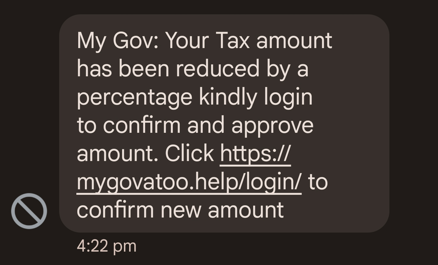

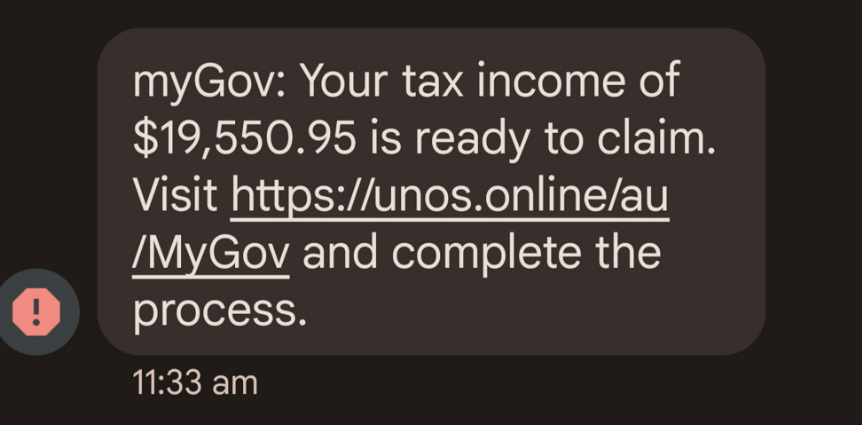

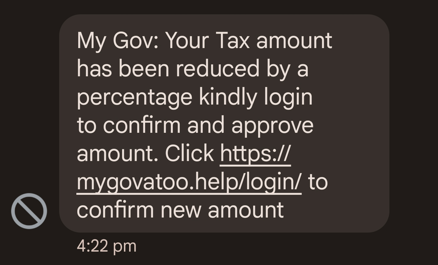

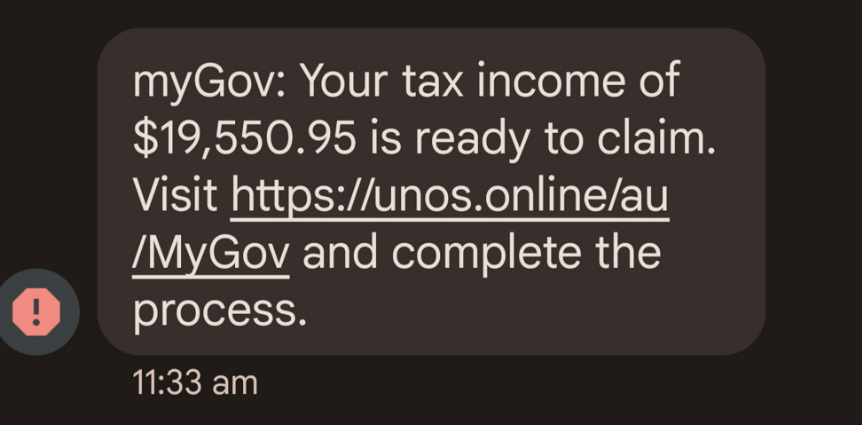

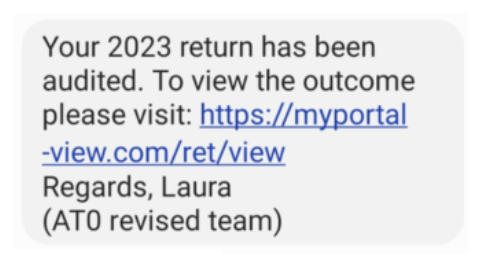

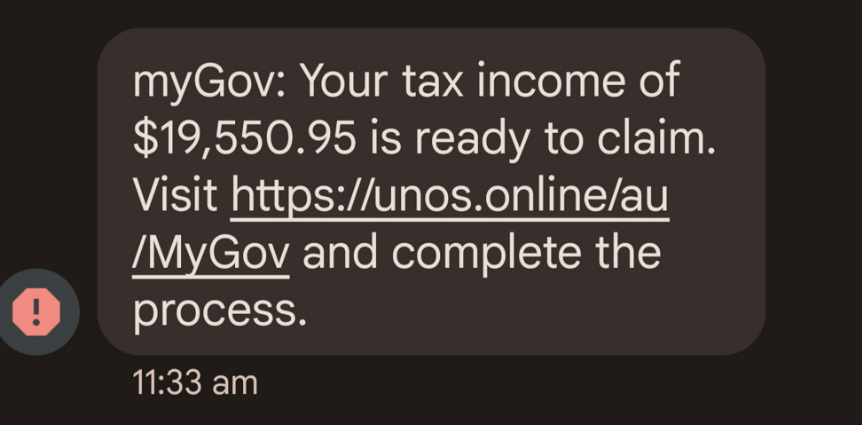

Individuals and businesses should be aware of increased scam activity as sophisticated cyber criminals take advantage of the busy tax period. During this busy time, scammers may use sophisticated tactics to try and catch you off guard. There are various types of scams, and the intent is clear - they want to steal your money or personal information.

Cyber criminals attempt to take advantage of this time of year with tax-related impersonation scams, namely those appearing to originate from the Australian Tax Office (ATO) or other government services such as myGov.

If you are unsure about the authenticity of a call or message, contact the ATO or applicable government service to verify.

For more information about rebate, refund and EOFY scams visit Rebate and refund scams online.

If you’ve received and responded to a message that you now believe is a scam, have shared your ANZ banking details, or you’re concerned your personal details have been compromised, please contact us straightaway

You can also report scams at Scamwatch.

For more information on how to protect yourself online, please visit the ANZ Security hub.

Posted on 19 May 2025

Type:

The ASD's ACSC has published an alert regarding 2 vulnerabilities affecting Ivanti Endpoint Manager Mobile (EPMM).

The 2 vulnerabilities the ASD's ACSC is tracking in Ivanti EPMM are:

When chained together, these vulnerabilities can provide unauthenticated attackers Remote Code Execution.

All versions of Ivanti EPMM prior to and including 12.5.0.0 are vulnerable.

ASD’s ACSC encourages Australian organisations to:

For more information, please refer to the Australian Cyber Security Centre’s alert: Multiple Vulnerabilities In Ivanti Endpoint Manager Mobile (Ivanti EPMM) | Cyber.gov.au

Posted on 17 April 2025

Type:

Malware is any kind of malicious software or code designed to exploit a computer, including computer viruses, worms, trojans, spyware or other malicious programs. Malware can be installed on a device without the user's knowledge or permission, often through email attachments, malicious websites, or compromised software.

To help protect our customers, ANZ uses security software that may detect if malware is present. If malware is detected, ANZ might lock your CRN from accessing Internet Banking. To get your CRN unlocked and proceed with Internet Banking, you will need to contact us.

ANZ’s customer protection teams and systems operate 24/7. Customers who believe they may have been a victim of a scam should contact us immediately, on 13 33 50 or visit us at https://www.anz.com.au/security/report-fraud/ for more information.

Report the scam to the Australian Signals Directorate’s ReportCyber portal. This resource is there for reports of scams where money or personal information has been lost.

Help others by reporting to Scamwatch to help them prevent future losses, monitor trends and educate the population about emerging threats.

Posted on 17 April 2025

Type:

The ASD's ACSC has published a critical alert regarding vulnerabilities affecting exploitation of existing Fortinet Vulnerabilities.

Customers are encouraged to update their devices and investigate for potential compromise.

Fortinet has released information regarding their observation of active exploitation of previously known vulnerabilities affecting Fortinet devices, including:

Fortinet have previously released patches for these vulnerabilities.

The observed post exploitation activity relates to either unpatched devices or those that were compromised prior to patching.

ASD’s ACSC encourages Australian businesses, organisations and government entities:

For more information, please read the Australian Cyber Security Centre’s alert: Exploitation of existing Fortinet Vulnerabilities | Cyber.gov.au

Posted on 08 April 2025

Type:

The ASD's ACSC has published a critical alert regarding vulnerabilities affecting Pulse/Ivanti Connect Secure, Policy Secure and Neurons for ZTA gateways (CVE-2025-22457).

Ivanti has released information regarding a critical unauthenticated buffer overflow vulnerability in Ivanti Connect Secure, Policy Secure and Neurons for ZTA gateways (CVE-2025-22457).

Ivanti has observed active exploitation associated with this vulnerability.

Affected products include:

Pulse Connect Secure 9.1X is end of support as of 31 December 2024.

ASD’s ACSC encourages Australian businesses, organisations and government entities:

For more information, please read the Australian Cyber Security Centre’s alert: Critical vulnerability in Pulse/Ivanti Connect Secure, Policy Secure and Neurons for ZTA gateways (CVE-2025-22457) | Cyber.gov.au

Posted on 28 March 2025

Type:

A critical alert has been published regarding vulnerabilities affecting Next.js authentication bypass.

The vulnerability could allow a remote attacker to bypass security checks, including many forms of authentication.

Affected versions/applications:

It is recommended that individuals, business, organisations and government to:

For more information, please read the Australian Cyber Security Centre’s alert: Next.js authentication bypass vulnerability (CVE-2025-29927)

Posted on 28 March 2025

Type:

A critical alert has been published regarding vulnerabilities affecting Ingress-NGINX Controller for Kubernetes.

The vulnerabilities could allow unauthenticated remote code execution and full cluster takeover.

The following vulnerabilities are:

It is recommended that businesses, organisations, and government entities:

For more information, please read the Australian Cyber Security Centre’s alert: Critical vulnerabilities in Ingress-NGINX Controller for Kubernetes

Posted on 12 March 2025

Type:

ANZ urges Australians to stay alert to cyber criminals attempting to exploit Ex-Tropical Cyclone Alfred's aftermath by impersonating trusted organisations through fake emails, texts, or calls. Cyber criminals may pose as banks, insurance companies, non-profit organisations, or disaster relief services to exploit those impacted by the natural disaster and deceive them into revealing personal information or making payments. Vigilance and caution is highly encouraged to protect personal information and ensure donations go to verified relief efforts.

Visit ANZ Media Release for more information.

In a genuine ANZ call, SMS message or email, we will never ask you to:

ANZ’s customer protection teams and systems operate 24/7. Customers who believe they may have been a victim of a scam should contact us immediately, on 13 33 50 or visit us at https://www.anz.com.au/security/report-fraud/ for more information.

Report the scam to the Australian Signals Directorate’s ReportCyber portal. This resource is there for reports of scams where money or personal information has been lost.

Help others by reporting to Scamwatch to help them prevent future losses, monitor trends and educate the population about emerging threats.

Posted on 21 February 2025

Type:

ScamWatch has published an alert advising that criminals posing as legitimate businesses are offering fake investment bonds, claiming that they offer high returns that are protected by the government. They encourage people to register their personal details on fake websites, steal money by getting people to buy fake investment bonds, and also use your personal details to commit other scams.

According to ScamWatch, there are steps you can take to help avoid investment scams:

If you suspect fraud on your account or have shared personal or financial information, or transferred money as a result of this scam, please contact us straightaway. Our Customer Protection Team is available 24/7 to help you.

Report the scam to the Australian Signals Directorate’s ReportCyber portal. This resource is there for reports of scams where money or personal information has been lost.

Help others by reporting to Scamwatch to help them prevent future losses, monitor trends and educate the population about emerging threats.

For more information, please read Scam alert: Investment bonds scam | Scamwatch

Posted on 05 February 2025

Type:

The ASD's ACSC has published an alert advising of emails and phone calls from cybercriminals claiming to be them.

The content of the scam emails and phone calls vary but typically ask you to give personal information (such as passwords or bank details), money or ask you to download software.

To make the scam emails appear legitimate, cybercriminals have been using the ASD’s ACSC logo and signature block.

Remember, never click on unknown or suspicious links, and always verify unexpected callers, emails or SMS requests through official channels.

If you suspect fraud on your account or have shared personal or financial information, or transferred money as a result of this scam, please contact us straightaway. Our Customer Protection Team is available 24/7 to help you.

Report the scam to the Australian Signals Directorate’s ReportCyber portal. This resource is there for reports of scams where money or personal information has been lost.

Help others by reporting to Scamwatch to help them prevent future losses, monitor trends and educate the population about emerging threats.

For more information, please read the Australian Cyber Security Centre’s alert.

Type:

A critical alert has been published regarding vulnerabilities affecting FortiOS & FortiProxy - Authentication bypass in Node.js websocket module.

The vulnerability may allow an unauthenticated remote attacker to gain “super-admin” privileges.

Affected versions/applications:

It is recommended that businesses, organisations, and government entities:

For more information, please read the Australian Cyber Security Centre’s alert: FortiOS & FortiProxy - Authentication bypass in Node.js websocket module vulnerability | Cyber.gov.au

![]()

Posted on 12 December 2024

Type:

We are aware of a new scam involving criminals impersonating trusted organisations like banks, IT companies, or phone companies, claiming that your bank accounts or computers are not secure. They may ask for your PIN and instruct you to leave your bank card in your letterbox so it can be cancelled and replaced. They may even ask you to withdraw cash and leave it in the letterbox instead.

These scammers use technology to spoof legitimate phone numbers and may call or send texts in the same thread as your real bank. Scamwatch reports indicate that older and vulnerable Australians living alone are being targeted, with large sums of money being stolen.

Scammers usually pretend to be from trusted organisations to gain your trust. They are likely to create fear about the security of your money or device, prompting you to act without verifying their claims. Once they have your card and PIN, they can withdraw money from your account.

STOP - Never tell anyone your PIN or give your card or cash to someone you don’t know. Say no, hang up, delete.

CHECK - Scammers call and pretend to be from organisations that you know and trust – like your bank. If you’re not sure, call the official number of the organisation to check. You can find this on their website, app or the back of your bank card.

PROTECT - If a scammer has taken your money, bank card or personal details, contact your bank or card provider immediately to report the scam and ask them to stop any transactions. Call the police if your cash or card has been taken by someone you don’t know.

If you have shared financial information or transferred money because of this scam, please contact us straightaway. Our Customer Protection Team is available 24/7 to help you.

Report the scam to the Australian Signals Directorate’s ReportCyber portal. This resource is there for reports of scams where money or personal information has been lost.

Help others by reporting to Scamwatch to help them prevent future losses, monitor trends and educate the population about emerging threats.

Posted on 11 December 2024

Type:

With the festive season upon us, it’s crucial to strengthen your defences against cybercrime and stay vigilant to scams.

During the busy end-of-year and peak online shopping period, our heightened online activity can make us more vulnerable to scams and cyber-attacks.

Cybercriminals often exploit this time of year, preying on people who may be more likely to respond to ‘urgent’ requests or clicking on fake websites. As we prepare for the festive season, it’s essential to be on the lookout for scams such as: Online Stores or Booking Agencies, Parcel Delivery, eCards and Charities.

Top tips to help protect yourself and your business this festive season:

If you suspect fraud on your account or have shared financial information or transferred money as a result of a scam, please contact us straightaway. Our Customer Protection Team is available 24/7 to help you.

Report the scam to the Australian Signals Directorate’s ReportCyber portal. This resource is there for reports of scams where money or personal information has been lost.

Help others by reporting to Scamwatch to help them prevent future losses, monitor trends and educate the population about emerging threats.

Posted on 11 December 2024

Type:

With the festive season upon us, it’s crucial for businesses to strengthen their defences against cybercrime and for consumers to stay vigilant.

The increased use of digital tools for everyday tasks has led to a surge in cyber-attacks, impacting both individuals and businesses. During the busy end-of-year and peak online shopping period, our heightened online activity can make us more vulnerable to scams and cyber-attacks.

Cybercriminals often exploit this time of year, preying on people who may be more likely to respond to ‘urgent’ requests or click on links in emails. As businesses prepare for the festive shutdown, it’s essential to ensure that cyber resiliency plans are up-to-date and that scam awareness is heightened.

Cybersecurity is a shared responsibility, and staying vigilant is crucial. By taking these proactive steps, you can help safeguard your business, your customers, and your staff against cyber threats during the festive season and beyond.

Top tips to help protect yourself and your business this festive season:

Protect the sensitive data you share and the data your organisation creates, collects, stores and shares. Never share passwords, PINS or OTP’s (one-time passwords)

If you suspect fraud on your account or have shared financial information or transferred money as a result of a scam, please contact us straightaway. Our Customer Protection Team is available 24/7 to help you.

You can also report scams to the Australian Government’s Scamwatch.

Posted on 02 December 2024

Type:

We are seeing a continuous rise in remote access scam attempts where cybercriminals impersonate bank representatives to gain unauthorised access to your systems. These scams may lead to significant financial losses and data breaches.

Cybercriminals often claim to be calling from a bank’s fraud department, referring to an account compromise, suspicious transaction, or online banking outage to create a sense of urgency. They may send messages that include a link to a website controlled by the scammer, where you might be prompted to enter important banking information.

Remember, ANZ will NEVER ask you to:

If you suspect fraud on your account, have shared financial information, or transferred money, please contact us immediately. Our Customer Protection Team is available 24/7 to help you.

Report the scam to the Australian Signals Directorate’s ReportCyber portal. This resource is there for reports of scams where money or personal information has been lost.

Help others by reporting to Scamwatch to help them prevent future losses, monitor trends and educate the population about emerging threats.

Type:

Be cautious when processing requests to update phone, email or bank details from third-party suppliers. These requests could be part of a payment redirection scam.

Cybercriminals may impersonate a legitimate supplier, create a fake business and ABN, and contact your business, requesting updates to supplier details such as:

Since contact details have been updated, verification processes may fail, leading to unintentional contact with the scammer.

If you suspect fraud on your account, have shared financial information, or transferred money, please contact us immediately. Our Customer Protection Team is available 24/7 to help you.

You can also report scams to the Australian Government’s Scamwatch and the Australian Cyber Security Centre’s ReportCyber.

Posted on 31 October 2024

Type:

ScamWatch has published an alert about criminals attempting to extort Australians through emails. The email falsely claims to have compromising images or videos of the intended victims obtained by hacking into people’s computers or webcams.

The criminals threaten to release the images or videos unless paid, using personal details like birth dates and addresses to intimidate victims. These details likely come from previous data breaches.

If you receive such emails, do not respond, or pay any money. This scam is a type of threat and impersonation scam, where criminals may use intimidation to extort money.

For more information visit: Scam alert: Bulk email extortion scam | Scamwatch

Information on how to help avoid scams after a data breach is available on the Scamwatch website.

Receiving scam emails is nothing to be ashamed of; it can happen to anyone. If you’ve shared personal information, contact IDCARE at 1800 595 160.

If you’ve responded to a scam message and shared your ANZ banking details or transferred money, contact ANZ immediately.

You can also report scams to the Australian Government’s Scamwatch and the Australian Cyber Security Centre’s ReportCyber.

Posted on 31 October 2024

Type:

The ASD's ACSC has published a critical alert regarding vulnerabilities affecting FortiManager devices.

Fortinet are aware of active exploitation of vulnerable instances. This vulnerability has been allocated a CVSSv3 score of 9.8.

Australian organisations are advised to review their networks for use of vulnerable instances of FortiManager devices and implement the mitigation advice provided by the vendor.

Affected Australian organisations are strongly recommended by the ASD’s ACSC to patch this vulnerability as a matter of high priority. Patch information is available at PSIRT | FortiGuard Labs.

Organisations or individuals that have been impacted or require assistance can contact the ACSC at ReportCyber.

For more information, please read the Australian Cyber Security Centre’s alert, Vulnerability in Fortinet’s FortiManager.

Posted on 21 October 2024

Type:

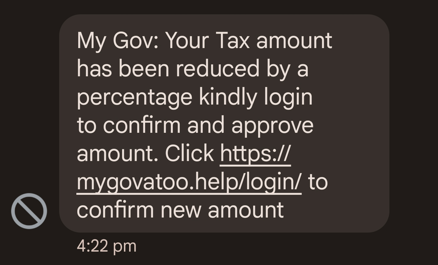

The National Anti-Scam Centre is warning consumers to be wary of bank impersonation scams. ANZ encourages customers to be cautious of any unsolicited calls, emails or messages from someone claiming to be from their bank, requesting they provide their personal or financial information, transfer funds, or provide a one-time security code over the phone.

Scammers often claim to be calling from the bank’s fraud department and may refer to an account compromise, suspicious transaction, or online banking outage to try to create a sense of urgency.

The call may appear to come from the bank’s legitimate phone number or a very similar number, or by a text message that appears in the same conversation thread as genuine bank messages or an email appearing to come from the bank.

Remember, ANZ will never ask you to:

Impersonation scams imitate not only banks, but government agencies, organisations and even friends or family members. Here are some tips to help you protect yourself:

For more information about bank impersonation scams, visit ANZ Security hub – types of scams – bank impersonation scams.

If you suspect fraud on your account or have shared financial information or transferred money as a result of this scam, please contact us straightaway. Our Customer Protection Team is available 24/7 to help you.

You can also report scams to the Australian Government’s Scamwatch and the Australian Cyber Security Centre’s ReportCyber.

Posted on 25 September 2024

Type:

The ASD's ACSC has sent a critical alert relevant to Australian organisations who are running or administering instances of Ivanti CSA 4.6 (Cloud Services Appliance).

Customers are encouraged to apply available mitigations and patches as soon as possible.

Organisations that use Ivanti CSA 4.6 (Cloud Services Appliance) should follow the mitigations advice provided in the Ivanti Security Advisory.

Ivanti advise that CSA 4.6 is End of Life and strongly recommends that their customers upgrade to CSA 5.0.

Organisations or individuals that have been impacted or require assistance can contact the ACSC via 1300 CYBER1 (1300 292 371).

For more information, please read the Australian Cyber Security Centre’s alert: Critical vulnerability in Ivanti CSA 4.6 (Cloud Services Appliance)

Posted on 20 September 2024

Type:

Unfortunately, we are still seeing instances of bank impersonation scams, and urge customers to be cautious of SMS messages or phone calls claiming to be from ANZ. Bank impersonation scams occur when a scammer makes direct contact with you suggesting that they’ve identified a problem and that they’re trying to assist you. Be cautious of SMS messages or phone calls, claiming to be from ANZ. The scammer may ask you to provide your sensitive personal and/or banking information, transfer money, open another account, click on a link, or download software.

Remember, ANZ will never ask you to:

Impersonation scams impersonate not only banks, but government agencies, organisations and even friends or family members. Here are some tips to help you protect yourself:

For more information about bank impersonation scams, visit ANZ Security hub – types of scams – bank impersonation scams.

If you suspect fraud on your account or have shared financial information or transferred money as a result of this scam, please contact us straightaway. Our Customer Protection Team is available 24/7 to help you.

You can also report scams to the Australian Government’s Scamwatch and the Australian Cyber Security Centre’s ReportCyber.

Type:

The ASD's ACSC has sent a critical alert regarding the vulnerabilities impacting Veeam Backup & Replication software.

There is significant exposure to the Veeam Backup & Replication vulnerabilities in Australia, and any future exploitation could have a significant impact on Australian systems and networks.

Australian organisations should review their networks for use of vulnerable instances of Veeam and implement the following mitigation advice.

A patch for vulnerabilities is available. Refer to the Veeam security advisory for further information on mitigation advice. The ACSC strongly recommends that affected Australian organisations patch this vulnerability as a matter of high priority.

Organisations or individuals that have been impacted or require assistance can contact the ACSC via 1300 CYBER1 (1300 292 371).

For more information, visit the Veeam Security Bulletin.

Type:

The ACSC has published a high alert regarding vulnerabilities affecting CVE-2023-46085 and CVE-2024-21887 applications (This vulnerability impacts all supported versions ICS (9.x, 22.x) and IPS).

According to the ACSC, the vulnerability can result in deploying the destructive WhisperGate malware, for the purposes of espionage, sabotage, and reputational harm.

The ACSC encourages Australian organisations/businesses to:

For more information, please read the Australian Cyber Security Centre’s webpage.

Posted on 30 August 2024

Type:

The ASD's ACSC has published a medium alert regarding email scammers impersonating the ASD's ACSC by sending out phishing emails to the public with the email content suggesting to download a malicious antivirus program.

The cybercriminals are emailing from spoofed email accounts utilising ASD’s ACSC’s logo, with the subject and contents of the email varying. These emails suggest that an increase in cyber threats requires the recipient to download ‘Antivirus’ software through a malicious link to stay safe. If clicked on, there is potential that malicious software could be downloaded and installed to the individual’s computer.

ASD’s ACSC encourages Australians to not click on links within the email, report it and block the sender. If you have clicked the link, require assistance, or if you’re not sure it’s a real email from ASD’s ACSC you can contact the ASD's ACSC via 1300 CYBER1 (1300 292 371).

For more information, please read the Australian Cyber Security Centre’s alert - Email scammers impersonating the ASD's ACSC.

Type:

ANZ is aware of a global incident affecting some CrowdStrike and Microsoft services and we are monitoring the situation closely. There is no impact to ANZ's services and systems at this point in time.

Scammers are using this global incident to their advantage and we’re warning customers and businesses to be cautious of unsolicited calls, emails or messages requesting they download a software patch or provide remote access to fix or protect their computer from the CrowdStrike/Microsoft outage.

Downloading unsolicited software can give scammers access to your computer, including your bank accounts.

Customers and businesses should also be on alert to unsolicited requests from individuals claiming to be from their financial institutions or other businesses requesting they update or verify their personal or financial information due to the CrowdStrike/Microsoft outage.

If you suspect fraud on your account or have shared financial information or transferred money as a result of this scam, please contact us straightaway. Our Customer Protection Team is available 24/7 to help you.

You can also report scams to the Australian Government’s Scamwatch and the Australian Cyber Security Centre’s ReportCyber.

Type:

ASD’s ACSC have published a critical alert regarding a CrowdStrike software update has led to worldwide outages impacting Windows systems on Friday 19 July 2024.

ASD’s ACSC strongly encourages all consumers to source their technical information and updates from official CrowdStrike sources only.

ASD’s ACSC is monitoring the situation and is able to provide assistance and advice as required. Organisations or individuals that have been impacted or require assistance can contact us via 1300 CYBER1 (1300 292 371).

For more information, please read the Australian Cyber Security Centre alert - Widespread outages relating to CrowdStrike software update

Posted on 19 July 2024

Type:

Whenever possible, try using different usernames and passwords/passphrases across multiple online platforms and websites. In the event of a data breach, your login details for these platforms or websites may get compromised and can be used in a cyberattack known as credential stuffing.

In a credential stuffing attack, the cybercriminal will use previously stolen usernames and passwords from one platform or website and use them on other platforms or websites in the hope that users are re-using them – to get unauthorised access to their user accounts.

This may lead to fraudulent transactions being made using the payment information saved in the user accounts on these platforms and websites.

Attacks of this nature are becoming more prevalent. To help safeguard your money and your information, we want to remind you of the following tips:

If you suspect fraud on your account, please contact us straightaway. Our Customer Protection Team is available 24/7 to help you.

You can also report scams to the Australian Government’s Scamwatch and the Australian Cyber Security Centre’s ReportCyber.

Posted on 05 July 2024

Type:

Whenever you browse the internet, be cautious of fraudulent pop-ups.

Pop-ups are windows or banners that automatically appear on a website and usually contain either advertising, notifications, or alerts. Often scammers use fraudulent pop-ups with warning messages to trick people into downloading software, click on links, or provide personal information. These fraudulent pop-ups are designed to create a sense of panic and may lead to personal data theft, financial loss, and broader security breaches within networks.

If you suspect fraud on your account or have shared financial information or transferred money as a result of this scam, please contact us straightaway. Our Customer Protection Team is available 24/7 to help you.

You can also report scams to the Australian Government’s Scamwatch and the Australian Cyber Security Centre’s ReportCyber.

Posted on 12 June 2024

Type:

We have been made aware of an increase in bank impersonation scams. Be cautious of SMS messages or phone calls, claiming to be from ANZ. They may ask you to transfer money, open another account, provide your sensitive banking details or download software.

Remember, we will never ask you to:

Impersonation scams impersonate not only banks, but government agencies, organisations and even friends or family members. Here are some tips to help you protect yourself:

For more information about bank impersonation scams, visit ANZ Security hub – types of scams – bank impersonation scams.

If you suspect fraud on your account or have shared financial information or transferred money as a result of this scam, please contact us straightaway. Our Customer Protection Team is available 24/7 to help you.

You can also report scams to the Australian Government’s Scamwatch and the Australian Cyber Security Centre’s ReportCyber.

Type:

Individuals should be aware of increased scam activity as sophisticated cyber criminals take advantage of the busy tax period. During this busy time, scammers may use sophisticated tactics to try and catch you off guard. There are various types of scams, and the intent is clear - they want to steal your money or personal information.

Cyber criminals attempt to take advantage of this time of year with tax-related impersonation scams, namely those appearing to originate from the Australian Tax Office (ATO) or other government services such as myGov.

Scammers may impersonate the ATO or myGov and threaten individuals and businesses with tax debt or offer rebates.

Individuals should stay alert to phishing, smishing (SMS phishing) and vishing (phone call phishing) scams. Always verify that requests are authentic before clicking on links, opening attachments or following instructions, particularly when it comes to your finances or personal information.

Otherwise, if you are unsure about the authenticity of a call or message, contact the ATO or applicable government service to verify.

Top tips to help protect yourself during tax time:

If you receive one of these messages, do NOT click on the link, and delete the message immediately.

If you’ve received and responded to a message that you now believe is a scam, have shared your ANZ banking details, or you’re concerned your personal details have been compromised, please contact us straightaway

You can also report scams at Scamwatch.

For more information on how to protect yourself online, please visit the ANZ Security hub.

Posted on 05 June 2024

Type:

The ASD's ACSC has published a high alert regarding increased cyber threat activity affecting Snowflake customer environments.

The ASD’s ACSC is aware of successful compromises of several companies utilising Snowflake environments.

ASD’s ACSC encourages Australian organisations who utilise Snowflake to reset credentials for active accounts, disable non-active accounts, enable Multi-Factor Authentication (MFA) and review user activity.

Snowflake has also published an advisory to assist in identifying instances of unauthorised access.

For more information, please read the Australian Cyber Security Centre’s alert, Increased cyber threat activity targeting Snowflake customers.

Posted on 05 June 2024

Type:

The ASD's ACSC has published a high alert regarding a vulnerability in Check Point’s Quantum Security Gateway devices that enables access of sensitive information to an unauthorised actor.

The ASD’s ACSC is aware of active exploitation of vulnerable instances.

ASD’s ACSC encourages Australian organisations to review their networks for use of vulnerable instances of Check Point’s Quantum Security Gateway and implement the mitigation advice provided by the vendor.

A hotfix for the vulnerability is available, and the ASD’s ACSC strongly recommends that affected Australian organisations patch this vulnerability as a matter of high priority.

For more information, please read the Australian Cyber Security Centre’s alert, CVE-2024-24919 - Check Point Security Gateway Information Disclosure.

Posted on 30 May 2024

Type:

We are aware of a new scam targeting customers of loyalty programs of large, well-known Australian companies (including but not limited to airlines, telecommunications and retail companies).

The scam is delivered to customers through a text message or email stating their loyalty points are expiring. This correspondence includes a link to a fake website, which prompts customers to login. Customers may also be asked to provide credit card details to use loyalty points.

If the customer follows the instructions as per the email or text, scammers will steal their points, login details and/or personal information to use on other platforms and commit identity fraud.

Tips to protect yourself from loyalty points scams:

For more information about this scam, visit Scamwatch.

If you’ve received and responded to a message that you now believe is a scam, have shared your ANZ banking details, or you’re concerned your personal details have been compromised, please contact us straightaway

You can also report scams at Scamwatch.

For more information on how to protect yourself online, please visit the ANZ Security hub.

Posted on 30 May 2024

Type:

Scammers may pose as online product comparison companies, financial firms, or create fake term deposit advertisements with better interest rates.

These fake advertisements can be difficult to spot.

If you share personal information on these fake websites and advertisements, a scammer might contact you, claiming to work for the promoting company and offer to open an account in your name. If you agree, you’ll be given fraudulent account details, and any money you transfer to this account will end up with the scammer.

If you suspect fraud on your account or have shared financial information or transferred money as a result of this scam, please contact us straightaway. Our Customer Protection Team is available 24/7 to help you.

You can also report scams to the Australian Government’s Scamwatch and the Australian Cyber Security Centre’s ReportCyber.

Posted on 30 May 2024

Type:

We are aware of a new scam involving the collection of physical credit/debit cards. The scam may originate as a phone call, claiming to be your Telco, IT support, or an online payment provider regarding your device being compromised.

The scammer may request you to download remote access software (such as Anydesk or TeamViewer) to ‘clean’ your device. This software enables the collection of your personal information, screensharing and monitoring of your online activity.

The scammer calls again asking if you have received a call in the last few days requesting you to download remote access software, and that you have likely been hacked.

The scammer may then attempt to convince you to hand over your physical card(s) by claiming that your existing card is compromised and needs to be replaced. They might arrange to collect your physical card(s) from your home by a courier or bank representative.

If you suspect fraud on your account or have shared financial information or transferred money as a result of this scam, please contact us straightaway. Our Customer Protection Team is available 24/7 to help you.

You can also report scams to the Australian Government’s Scamwatch and the Australian Cyber Security Centre’s ReportCyber.

Type:

You may receive a call claiming to be from ANZ asking you to authorise a transaction on your account. The call is commonly delivered as a recorded message (asking you to press 1 to proceed), however, it may also be someone cold calling you posing as an ANZ officer. We have also received reports of this scam being delivered via SMS with a number to call to “confirm” the transaction.

If you respond to the recorded message or contact the number provided in the SMS, you might speak with a scammer who will attempt to trick you into following instructions (e.g. transferring money to a “safe” account) with the objective of stealing your money or personal details.

ANZ will never ask you to share sensitive banking details (like your password, PINs, ANZ Shield code or one-time passcode (OTP) for payment in an email or SMS), click a link to log in to your account, grant remote access to your computer or device or transfer money to another account.

If you suspect fraud on your account or have shared financial information or transferred money as a result of this scam, please contact us straightaway. Our Customer Protection Team is available 24/7 to help you.

You can also report scams to the Australian Government’s Scamwatch and the Australian Cyber Security Centre’s ReportCyber.

Type:

The ASD's ACSC has published a critical alert regarding vulnerabilities affecting Palo Alto’s PAN-OS 10.2, PAN-OS 11.0, and PAN-OS 11.1 firewalls.

According to the ASD’s ACSC, the vulnerability can result in an unauthenticated attacker executing arbitrary code with root privileges on the firewall.

The ASD’s ACSC has stated that Australian organisations who have a Palo Alto Threat Prevention subscription can block attacks for this vulnerability by enabling Threat ID 95187.

For more information, please read the Australian Cyber Security Centre’s alert, OS Command Injection Vulnerability in GlobalProtect Gateway.

Type:

Messages appear to come from well-known companies and organisations such as the Australian Taxation Office (ATO) asking you for payment and with a link to proceed. The link typically directs you to a legitimate looking website to capture your card or banking details, often including the PIN or one-time passcode (OTP). The information you populate on these websites may be used to steal your money.

If you suspect fraud on your ANZ account or have shared financial information or transferred money, please contact us straightaway. You can also make a report to ReportCyber and Scamwatch.

Type:

The ASD's ACSC has published a critical alert regarding vulnerabilities affecting Fortinet’s FortiClientEMS 7.2 to 7.2.2 and FortiClientEMS 7.0 to 7.0.10.

According to the ASD’s ACSC, CVE-2023-48788 can result in remote code execution by an unauthenticated threat actor to execute unauthorised code or commands via a specifically crafted request.

ASD’s ACSC encourages Australian organisations to review their networks for use of vulnerable instances of the FortiClientEMS and apply patches available from Fortinet.

For more information, please read the Australian Cyber Security Centre’s alert, Critical vulnerabilities affecting Fortinet’s FortiClient EMS

Type:

ANZ understands that Tangerine Telecom is investigating a cyber-attack, resulting in the unauthorised access of its customers’ information.

Tangerine Telecom have advised via a media release that the information exposed may include personal information of their current and past customers.

Please visit Tangerine Telecom for further information.

Please refer to our dedicated Data Breach Customer Support page where you’ll find useful information and resources.

Type:

Applicable to individuals and IT teams of organisations and government who use Microsoft Office Outlook products.

The ASD's ACSC has published a critical alert regarding a vulnerability that exploits the Outlook preview pane as an attack vector, enabling malicious code execution in edit mode rather than the restricted protected view.

This vulnerability affects customers running the following Microsoft products:

Microsoft Office 2016

Microsoft Office LTSC 2021

Microsoft 365 Apps for Enterprise

Microsoft Office 2019

For more information, please read the Australian Cyber Security Centre’s alert, Microsoft Office Outlook Remote Code Execution Vulnerability.

Type: ![]()

In recent weeks, there have been numerous reports of data breaches in Australia and around the globe – all of which can lead to credential stuffing.

In a credential stuffing attack, the cybercriminal will use previously stolen usernames and passwords from one website and use them on other websites in the hope that users are re-using them – to get unauthorised access to their user accounts.

This may lead to fraudulent transactions being made using the payment information saved in the user accounts on these websites.

Attacks of this nature are becoming more prevalent. To help safeguard your money and your information, we want to remind you of the following tips:

Use a different password/passphrase for different accounts

Use multi-factor authentication (MFA) on all accounts, wherever possible.

Change your password/passphrase immediately, if impacted by a data breach.

If you suspect fraud on your account or have shared financial information or transferred money as a result of this scam, please contact us straightaway. Our Customer Protection Team is available 24/7 to help you.

You can also report scams to the Australian Government’s Scamwatch and the Australian Cyber Security Centre’s ReportCyber.

Type:

ANZ is aware of a new scam on the rise involving “accidental deposits” on business customer accounts.

The scam begins with an unexpected payment being received in a customer’s account. The cybercriminal then contacts the customer stating that they’ve made an accidental deposit to the customer’s account, and requesting that they transfer the money back. The account the cybercriminal directs the customer to pay the “accidental deposit” is their own account.

Variations of this scam may involve a false call from the “bank” requesting funds to be transferred back into the sender’s account.

Please note, ANZ will never ask you to transfer funds to another account.

If someone pays you unexpectedly and requests the payment to be returned, ask them to reach out to their bank to initiate a recall instead. Do not send the money back yourself.

Always be wary of unexpected emails and messages as this may lead you to divulge your banking details - never click on links or download attachments from unexpected messages or emails.

If you suspect fraud on your account or have shared financial information or transferred money as a result of this scam, please contact us straightaway. Our Customer Protection Team is available 24/7 to help you.

You can also report scams to the Australian Government’s Scamwatch and the Australian Cyber Security Centre’s ReportCyber.

Posted on 31 January 2024

Type:

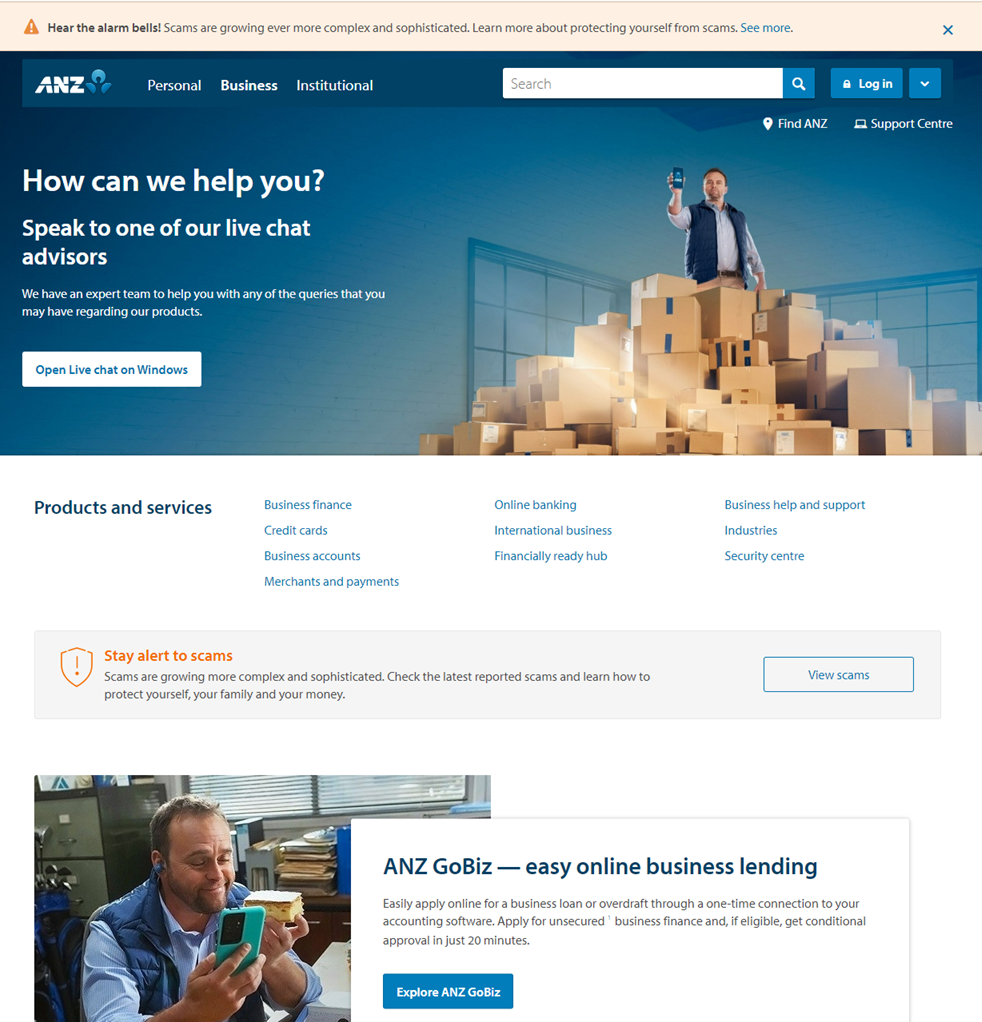

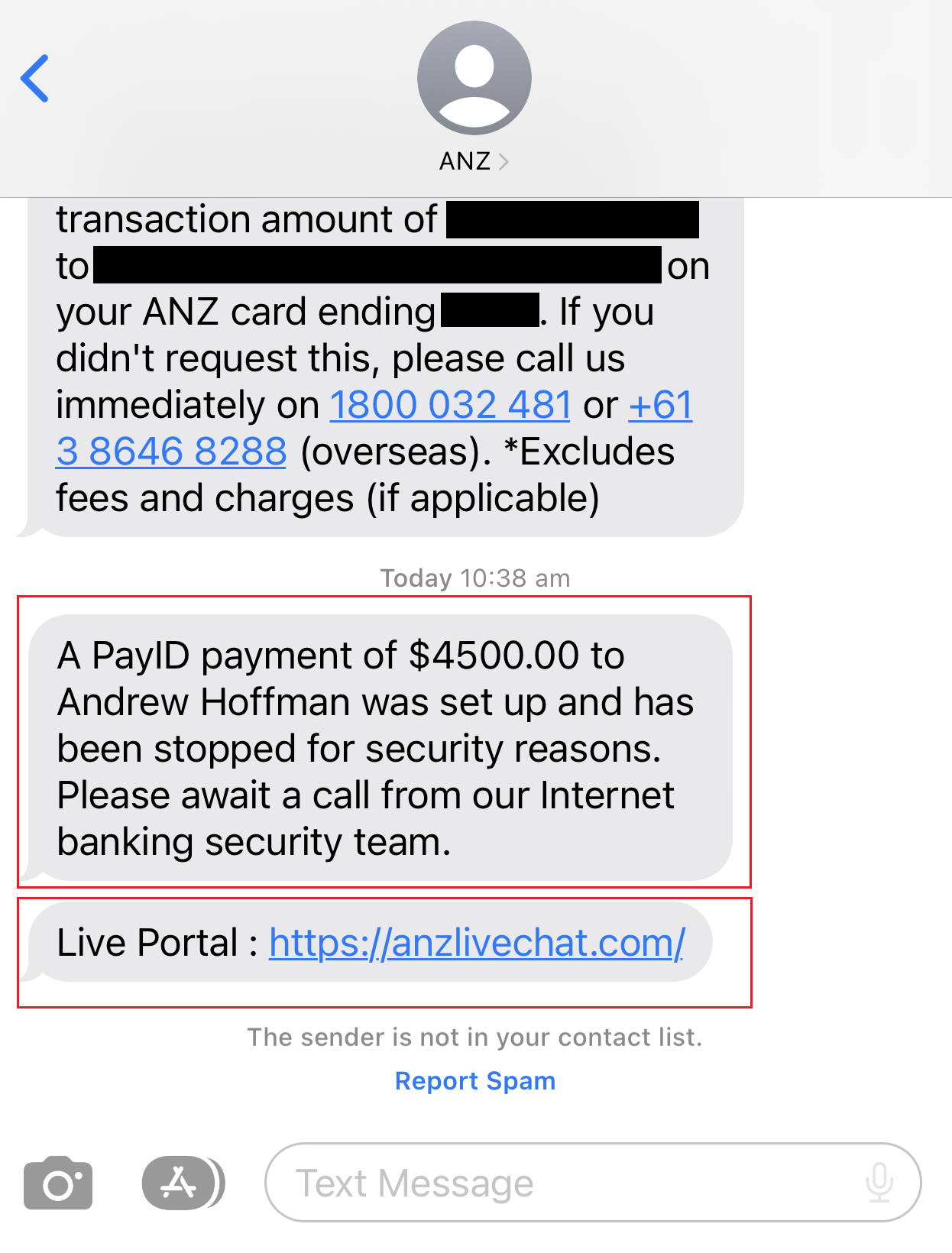

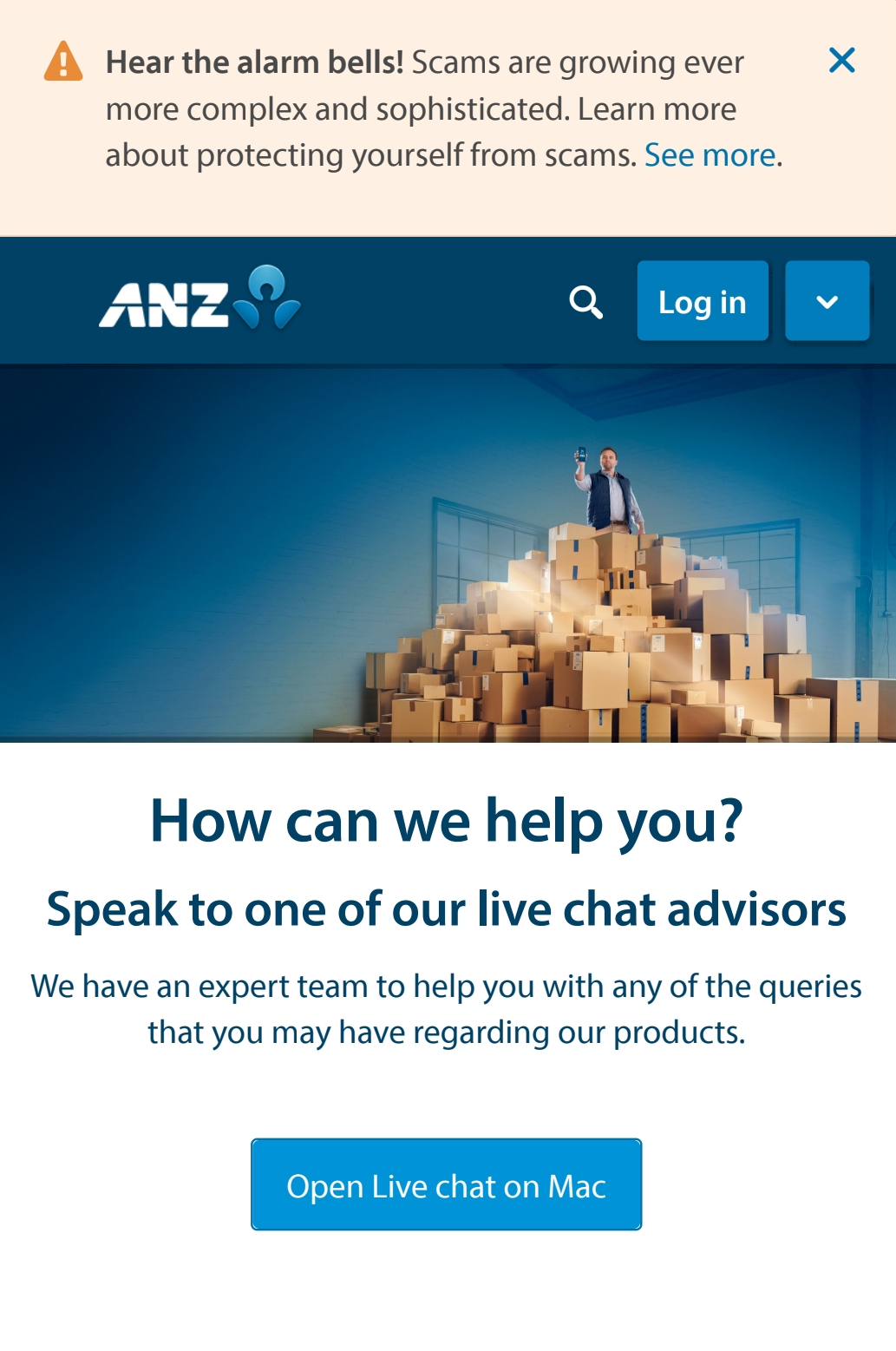

We have observed another variation of the "Live Chat” bank impersonation scam whereby customers are asked to click on a link, via SMS or email to receive security assistance on their accounts.

This link leads to a fake ANZ website with a button to "Open live chat on Windows". The website may look very convincing. If the customer clicks on the button, software will be downloaded on the customer's device providing the scammer remote access to the device.

The scammer (impersonating an ANZ employee), may ask the victim to log into their online banking account, allowing the scammer to capture the customer's login credentials. The scammer may also take over the session and perform transactions or ask the customer to transfer their money into a "safe" account.

Please note, ANZ does not currently have a "live chat" feature.

Remember, ANZ will never ask you to:

Important reminder: Never provide sensitive banking details or access to anyone, even if they claim to work for ANZ.

If you’ve transferred money or shared your ANZ banking details in response to what you believe may be a scam, please contact ANZ immediately.

You can also report scams to Scamwatch. For more information on how to protect yourself online, please visit the ANZ Security Centre.

Posted on 29 January 2024

Type:

Applicable to businesses that are running or administering instances of Ivanti Connect Secure (ICS) and Ivanti Policy Secure (IPS).

The ASD's ACSC has published a high alert regarding vulnerabilities in the Ivanti Connect Secure and Ivanti Policy Secure gateways. These vulnerabilities impact all supported versions – Version 9.x and 22.x.

ASD’s ACSC encourages impacted Australian organisations to apply any available mitigations and patches as soon as possible.

For more information, please read the Australian Cyber Security Centre’s alert, Critical vulnerabilities in Ivanti Connect Secure (ICS) and Ivanti Policy Secure (IPS).

Posted on 29 January 2024

Type:

The NASC urges Australians looking to earn extra money through online ‘side hustles’ to be careful of scammers. This warning comes after reported losses to Scamwatch for jobs and employment scams almost tripled in 2023 (from $8.7m in 2022 to $24.7m in 2023).

According to the Australian Competition and Consumer Commission (ACCC) Deputy Chair Catriona Lowe , “Scammers are targeting people looking for online work in their spare time, promising them guaranteed income from jobs that include boosting the ratings of products and services through an online platform. In some cases, the jobs are as simple as liking posts on social media such as TikTok videos.” These scammers typically pretend to be from well-known retailers, department stores or pose as social media marketing agencies.

The victims often report that they responded to an advertisement on social media about a job opportunity. The scammer will then contact the victim directly via encrypted messaging apps such as WhatsApp. “The scam operates similar to an online game, with victims reporting that they are pressured to make an initial investment of their own money, along with ongoing payments in order to ‘level up’ and receive a higher income which they never receive,” Ms Lowe said.

For more information, please read the ACCC media release, Looking to earn extra cash? Don’t lose money to a side hustle scam.

Posted on 19 January 2024

Type:

Applicable to businesses using Atlassian Confluence Data Center and Confluence Server.

The ASD's ACSC has published a critical alert regarding a remote code execution (RCE) vulnerability in Atlassian Confluence Data Center and Confluence Server.

ASD’s ACSC encourages Australian organisations to review their networks for use of vulnerable instances of Atlassian Confluence Data Center and Confluence Server, and consult Atlassian’s customer advisory for mitigation advice.

For more information, please read the Australian Cyber Security Centre’s alert, Remote Code Execution Vulnerability In Confluence Data Center and Confluence Server.

Posted on 19 January 2024

Type: ![]()

ANZ is aware of a cyber security incident, known as, credential stuffing, affecting major brands in Australia, including but not limited to Dan Murphy’s, Event Cinemas, Binge, The Iconic, Guzman y Gomez, and TVSN.

According to the Australian Cyber Security Centre (ACSC), credential stuffing is a type of hack in which cyber criminals use previously stolen passwords from one website and try to use them elsewhere – targeting those who reuse their passwords on multiple websites. This may lead to fraudulent transactions being made using the payment information saved in the user accounts on these websites.

Here are some tips to help you protect yourself online:

If you’ve received and responded to a message that you now believe is a scam, and have transferred money, shared your ANZ banking details and/or account credentials, contact ANZ immediately.

You can also report scams at Scamwatch.

For more information on how to protect yourself online, please visit the ANZ Security Centre.

Posted on 18 January 2024

Type:

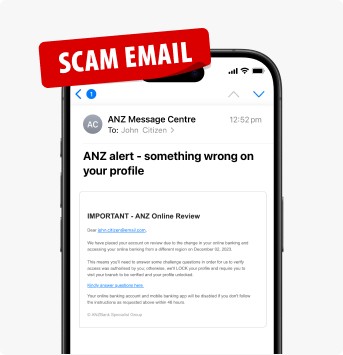

Many Australians have recently been targeted by scams involving digital wallets.

Digital wallets enable eligible credit and debit card holders to store their card information on a device such as mobile phone, or wearable device such as a Fitbit. This enables the card holder to make transactions without the need to carry the physical card.

Whilst digital wallets are safe, it is important to consider that scammers may try to link your credit or debit card to their own device and make unauthorised purchases.

Digital wallet scams usually start with SMS messages that appear to come from well-known companies, for example Netflix, Linkt or the Australian Taxation Office (ATO). The messages suggest that your recent payment has failed, or that you are owed a refund, and your card details are required to be entered via a link. The link directs you to a legitimate looking website that is designed to maliciously capture your card details, often including the PIN. These details are used by the scammer to register the card information to a digital wallet on their device.

To complete the digital wallet registration, a verification code is sent to you by SMS. If the scammer obtains this verification code, they will be able to link your credit or debit card to their own device and make purchases with your card.

The scammer may wait several months before attempting to link your credit or debit card information to their device. When they do, they might impersonate a bank officer and convince you to divulge the verification code.

If you’ve received and responded to a message that you now believe is a scam, and have transferred money, shared your ANZ banking details and/or account credentials, contact ANZ immediately.

You can also report scams at Scamwatch.

For more information on how to protect yourself online, please visit the ANZ Security Centre.

Posted on 18 January 2024

Type:

Applicable to users of GitLab on any platform

The ASD's ACSC has published a critical alert regarding vulnerabilities affecting Gitlab Community Edition (CE) and Enterprise Edition (EE). The most severe vulnerability allows an account take over via the ability to have password reset emails delivered to an unauthenticated email address.

ASD’s ACSC encourages customers to patch to the latest version using the GitLab upgrade path and to enforce multi-factor authentication for all GitLab accounts.

For more information, please read the Australian Cyber Security Centre’s alert, Critical vulnerabilities in GitLab Products.

Posted on 17 January 2024

Type:

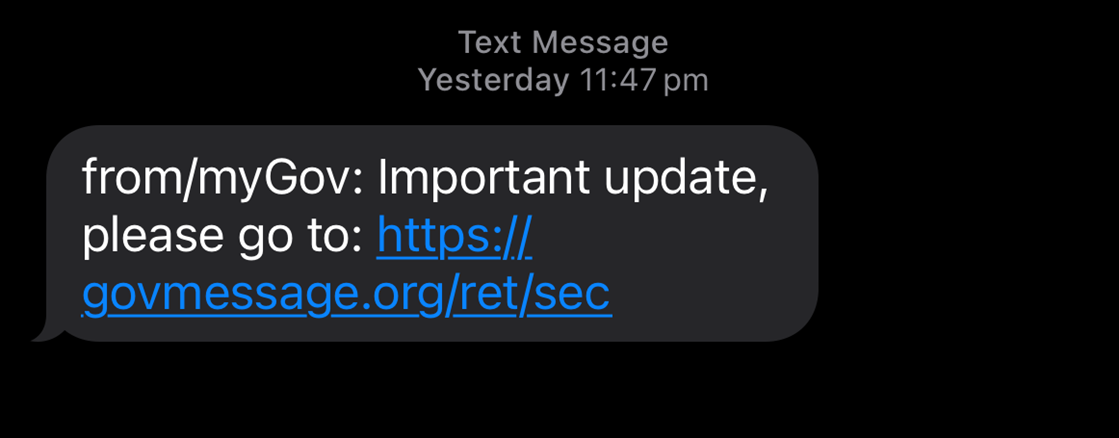

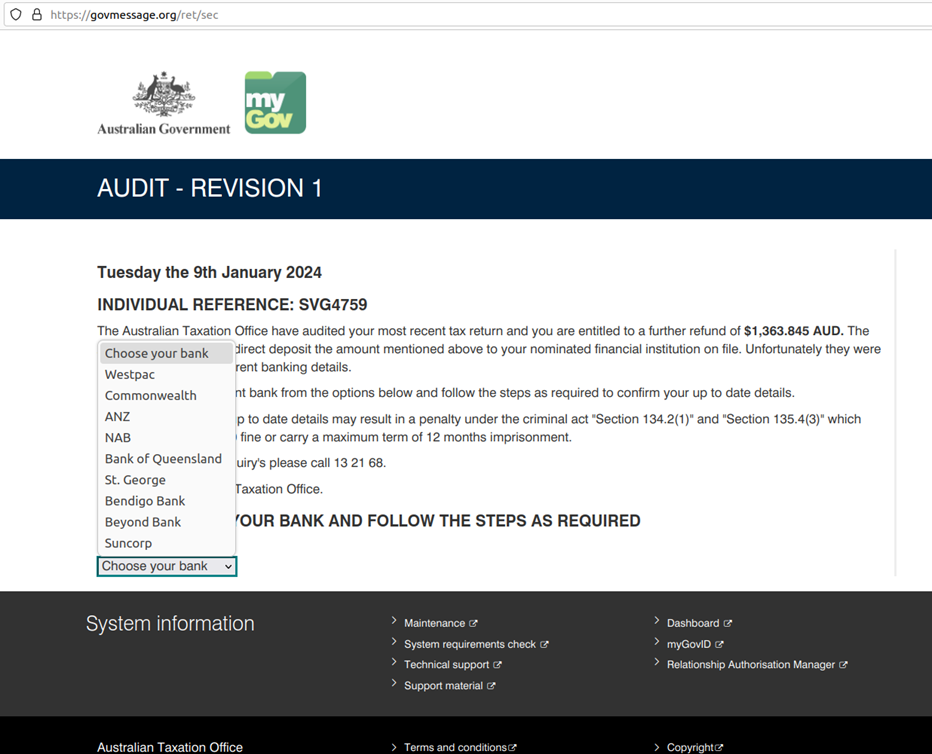

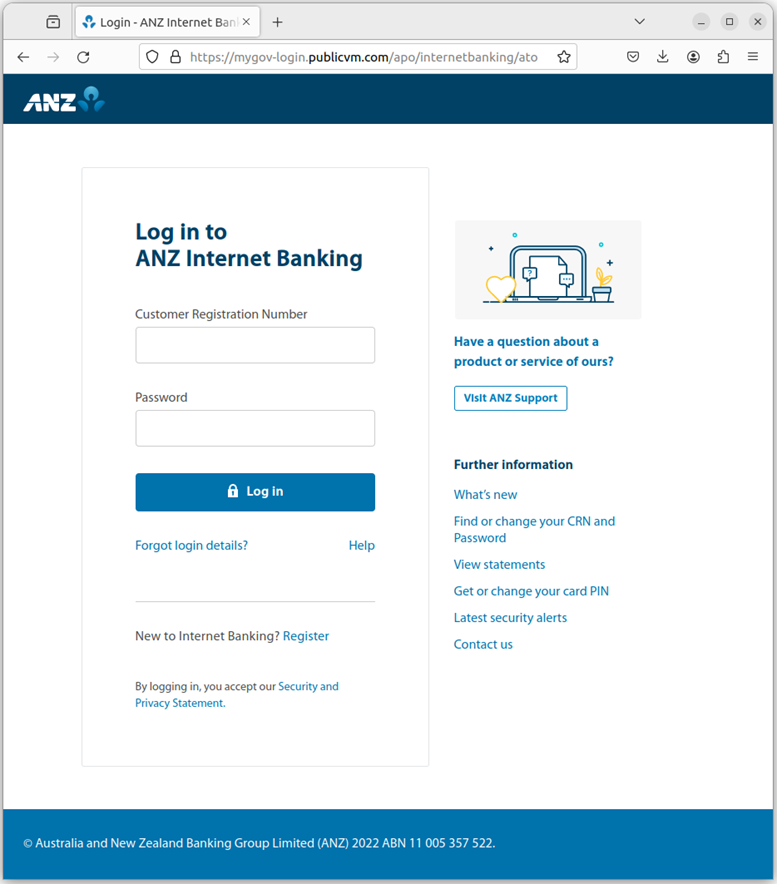

We are aware of a sophisticated scam that has been designed to steal banking information from individuals.

The scam begins with an SMS that claims to be from myGov or the Australian Tax Office (ATO). The SMS prompts the user to click on a link where they will be taken to a fake web page claiming the individual is entitled to an additional refund on their tax return and the individual must verify their bank details to receive it.

On this page, the individual will see a list of financial institutions to choose from. Once a selection has been made, they will be redirected to a fake internet banking login page which will capture the individual’s banking details.

The ATO states that they will never send you a text message asking you to click on a link to give personal information.

If you suspect fraud on your account or have shared financial information or transferred money as a result of this scam, please contact us straightaway. Our Customer Protection Team is available 24/7 to help you.

You can also report scams to the Australian Government’s Scamwatch and the Australian Cyber Security Centre’s ReportCyber.

![]()

Posted on 14 December 2023

Type:

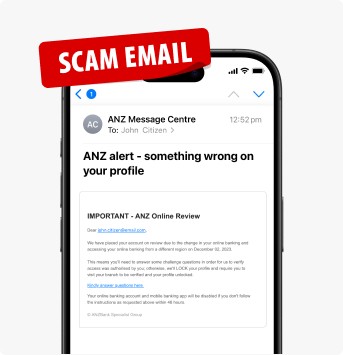

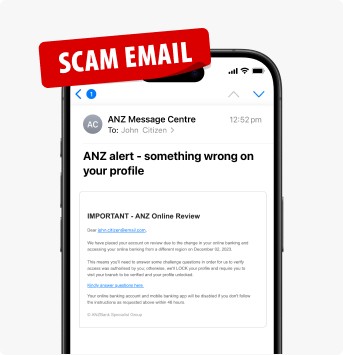

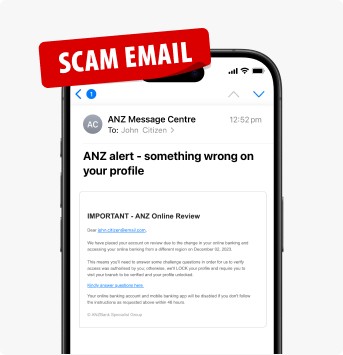

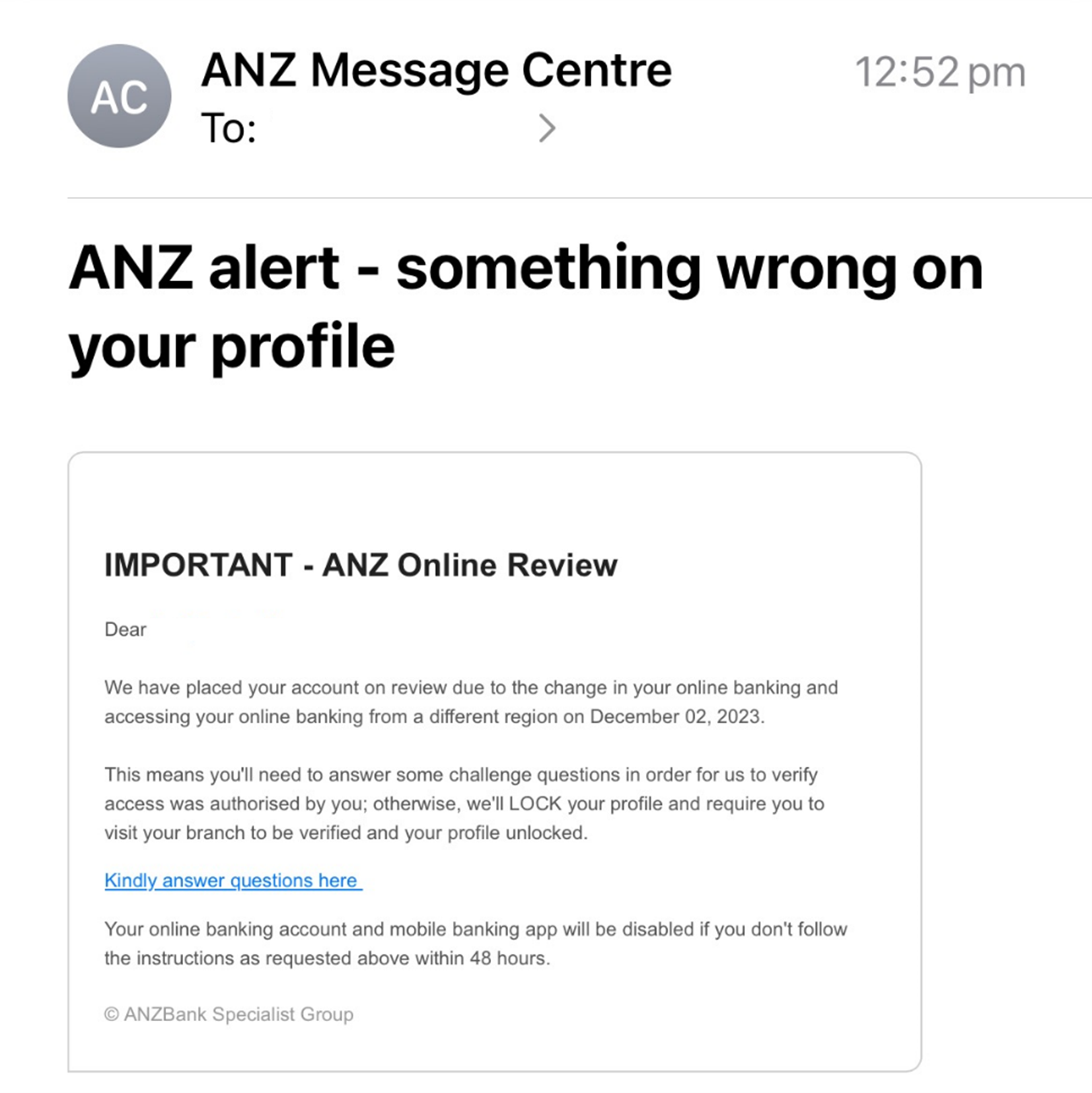

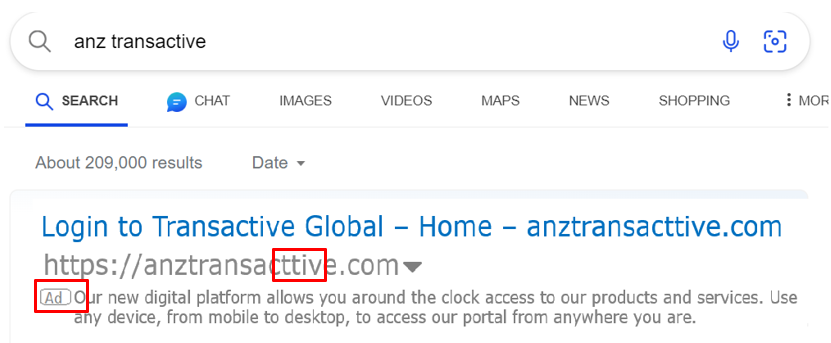

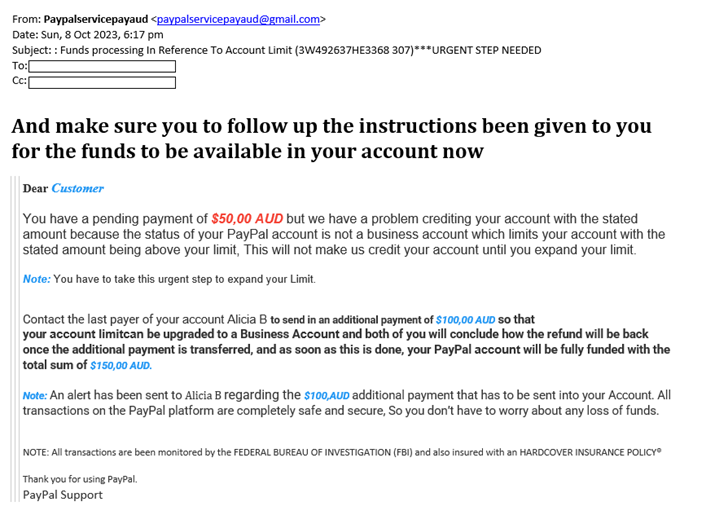

We have been made aware of an email impersonating ANZ asking recipients to click a link and respond to security questions for account verification. The fake email claims that the recipients account is under “review” and their profile will be locked unless they click the link and answer some “challenge questions” to “verify access”. The fake email also claims that access to online banking and the mobile banking app “will be disabled” unless the recipient follows the instructions in the email within “48 hours”. The website collecting responses from the link now has been taken down, but customers are still encouraged to be vigilant against such attempts which may access personal and/or financial information.

Impersonation scams impersonate not only banks, but government agencies, organisations and even friends or family members. Here are some tips to help you protect yourself:

If you have received and responded to a message that you now believe is a scam, have shared your banking details, or you are concerned your personal details have been compromised, contact ANZ immediately.

You can also report scams to Scamwatch. For more information on how to protect yourself online, please visit the ANZ Security Centre.

Posted on 12 December 2023

Type:

We are aware of a scam targeting online hotel and accommodation booking platforms users. Fake emails seemingly from the booking platform urgently asks users for payment authorisation to avoid cancellation of their booking. Another variation of this scam is notifying users that their payment was declined, and it needs to be resolved immediately.

These phishing emails contain guest and reservation details making them look legitimate and have links that users are urged to click on to process their payment and retain their reservation.

Scammers also set up official looking fake hotel and travel websites with prices that are too good to resist in order to lure unsuspecting victims.

Prevent falling for this scam by contacting the booking platform or hotel directly through verified contact details instead of the provided links in the emails and double check the sender’s address. Keep track of your finances and if there are unauthorised or duplicate charges, call your bank immediately.

For more information visit Security Centre at anz.com or Stay Cyber Safe.

Posted on 11 December 2023

Type:

Applicable to all businesses using Atlassian products including Confluence, Jira and Bitbucket

The ASD's ACSC has published a high alert regarding serious vulnerabilities in Atlassian products including Confluence, Jira and Bitbucket. It is noted that previous critical vulnerabilities in these products have been significantly exploited by cyber criminals.

ASD’s ACSC recommends that if you operate Confluence, Jira or Bitbucket, that you review the vendor advisories to determine if you are affected. Affected organisations are advised to act now to secure their systems by applying all vendor recommended mitigations.

For more information, please read the Australian Cyber Security Centre’s alert, Serious vulnerabilities in Atlassian products including Confluence, Jira and Bitbucket.

Posted on 27 November 2023

Type:

Applicable to all businesses using Citrix NetSCaler ADC and NetScaler Gateway

The ASD's ACSC has published a critical alert regarding vulnerabilities in Citrix NetScaler ADC and NetScaler Gateway that may be in use on Australian networks.

ASD’s ACSC is aware that there have been successful exploitation attempts against Australian organisations and recommended that affected entities review the available mitigations and apply where possible as a matter of high priority.

The ASD’s ACSC has assessed that there is significant exposure to these Citrix NetScaler ADC and NetScaler Gateway vulnerabilities in Australia and that any future exploitation of these vulnerabilities would have a significant impact to Australian systems and networks. ASD’s ACSC advises that Australian organisations should review their networks for use of vulnerable instances of Citrix NetScaler ADC and NetScaler Gateway. The ASD’s ACSC has strongly urged affected organisations to install the relevant updated versions of Citrix NetScaler ADC and NetScaler Gateway as soon as possible.

For more information, please read the Australian Cyber Security Centre’s alert, Citrix Products NetScaler ADC and NetScaler Gateway Vulnerabilities.

Posted on 8 November 2023

Type:

The Home Affairs and Cyber Security Minister, Clare O’Neil has urged businesses to immediately address software vulnerabilities and conduct patch management to help prevent cyberattacks. (Australian Financial Review, 2023)

Businesses should ensure that software bugs are regularly patched and upgraded, for systems to function properly and securely.

Patches are updates that address specific software vulnerabilities. Cyber criminals can exploit these vulnerabilities when left unmanaged, leading to cyberattacks. Regular patching and updates can protect against cyber threats, but can also improve the performance of the system, thus keeping business operations running smoothly.

For more information, visit the Australian Cyber Security Centre and search for Alerts and Advisories.

Posted on 8 November 2023

Type:

We’re aware of an impersonation scam taking advantage of the Optus network outage on 8 November 2023.

If you think you’ve received an unusual message or call – or if you’d like to report fraud, please contact us straightaway. Our Customer Protection Team is available 24/7 to help you. .

Posted on 08 November 2023

Type:

Fake product comparison websites created by scammers are being used to dupe people who are searching online for financial products like term deposits.

Scammers pose as online product comparison companies, promoting accounts with higher-than-average interest rates. If you share personal information on one of these sites, a scammer might contact you, claiming to work for the product comparison company and offering to open an account in your name. If you agree, you’ll be given bogus account details. Any money you transfer to this account will end up with the scammer.

If you think you’ve received an unusual message or call – or if you’d like to report fraud, please contact us straightaway. Our Customer Protection Team is available 24/7 to help you. You can also report scams to the Australian Government’s Scamwatch.

Posted on 19 October 2023

Type:

It has come to our attention that scammers posing as Chinese authorities are contacting young people studying and/or living in Australia to financially extort them using various threatening and intimidating tactics.

Targeted individuals are contacted through phone calls or messaging apps like Telegraph, WhatsApp, or WeChat. Mandarin-speaking scammers pose as Chinese authorities, police, staff from the Chinese Embassy or Consulate, or immigration officials. These scammers are falsely threatening criminal charges, extradition and/or deportation unless money is sent to those scammers.

In a variation of this scam, instead of directly asking the targeted individual for money, scammers will force victims to fake their own kidnapping and take photographs of themselves in vulnerable positions. This will then be used by the scammers to manipulate the victim’s family into paying a ransom.

If you’ve received and responded to a message that you now believe is a scam, and have transferred money or shared your ANZ banking details and/or account credentials, contact ANZ immediately.

You can also report scams to the Australian Government’s Scamwatch.

For more information on how to protect yourself online, please visit the ANZ Security Centre. Content is available in simplified and traditional Chinese via Scamwatch.

Posted on 08 September 2023

Type:

We are aware of an emerging scam targeting elderly Australians through fake websites or cold calls claiming to supply seniors discount card memberships.

According to the National Anti-Scam Centre (NASC), seniors may be targeted through a fake website that claims to be “officially approved” and offers to provide seniors discount card membership for a fee. In other instances, scammers are cold calling the elderly offering a fake seniors discount card and are asking for personal information over the phone. If personal information is subsequently provided to the scammer, they may use this information to commit identity fraud.

Please be aware that government bodies within Australia supply seniors card memberships for no cost, and therefore, seniors will never be asked to pay a membership or application fee.

Tips to help protect yourself or your loved ones:

If you’ve received and responded to a message that you now believe is a scam, have shared your ANZ banking details, or you’re concerned your personal details have been compromised, contact ANZ immediately.

You can also report scams to Scamwatch.

For more information on how to protect yourself online, please visit the ANZ Security Centre.

Posted on 24 August 2023

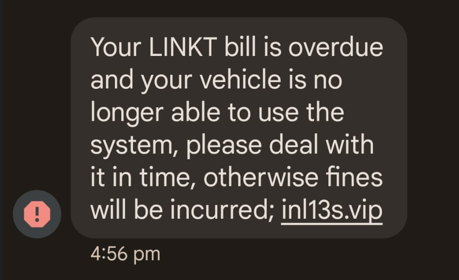

Type:

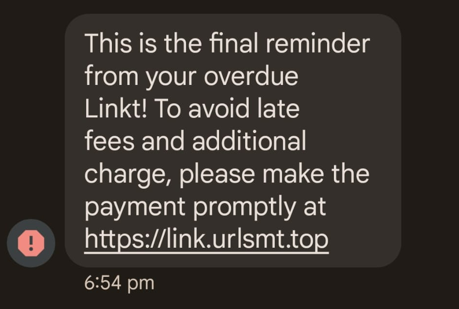

ANZ is aware of SMS phishing scams that impersonate toll road operators. These scams typically claim that an overdue toll notice is outstanding and needs to be settled immediately. Individuals may be threatened with late fees, severe penalties or negative impacts on credit scores for non-compliance. Scammers might claim that the individual’s vehicle may be (or has been) suspended.

To resolve the issue, the individual is prompted to follow a link to a fake website, designed to steal personal or financial details.

These SMS messages may come from a random number, or may be ‘spoofed’, appearing to originate from the legitimate toll road operator.

Remember:

If you’ve received and responded to a message that you now believe is a scam, and have transferred money, shared your ANZ banking details and/or account credentials, contact ANZ immediately.

You can also report scams at Scamwatch. For more information on how to protect yourself online, please visit the ANZ Security Centre.

Posted on 18 August 2023

Type:

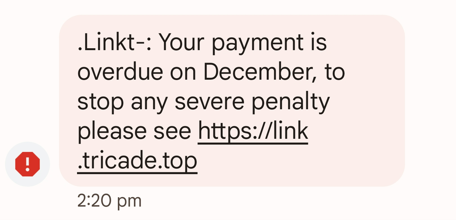

Customers are advised that we’ve identified fake websites impersonating ANZ Transactive Global, with searches for ANZ Transactive being redirected to a fake site. The fake website’s log in page asks for a customer’s User ID, Password, Token or ANZ Digital Key, and mobile number to urgently update customer details through a series of verification pages, and ends with a message saying an ANZ representative will be calling them shortly. This information gives the fraudster enough details to be able to gain trust as an ANZ employee with the intention of committing fraud.

Fraudsters pay for ads to secure top search engine positions, exploiting users' trust and increasing the likelihood of successful scams.

Tips to help you bank securely:

If you’ve received and responded to a message that you now believe is a scam, and have transferred money, shared your ANZ banking details and/or account credentials, contact ANZ immediately.

You can also report scams at Scamwatch.

For more information on how to protect yourself online, please visit the ANZ Security Centre.

Posted on 10 August 2023

Type:

We are aware of scammers building relationships with people in order to build their trust and subsequently luring them into an investment scam. The scam starts with an unexpected message or request (including via email, social media platforms, messaging apps, etc.) from the scammer using a fake identity.

Once the scammer has built the individual’s trust, the scammer then manipulates the individual into believing they should quickly transfer money and/or provide personal and financial details to take advantage of a low-risk, high return investment. The scammer may offer to help the individual with their investments (by claiming to set up their accounts or trade on their behalf) or offer to teach the individual how to invest.

The scammer will typically disappear after the payment has been made or continue seeking opportunities to collect more money.

How to help protect yourself from Romance-Investment Scams:

You should make your own reasonable enquiries and check if a financial adviser is registered via the ASIC website and check ASIC’s list of companies you should not deal with. If the company that is asking for your investment is on the list – do not deal with them.

If you’ve received and responded to a message that you now believe is a scam, and have transferred money, shared your ANZ banking details and/or account credentials, contact ANZ immediately.

You can also report scams at Scamwatch.

For more information on how to protect yourself online, please visit the ANZ Security Centre.

Posted on 27 July 2023

Type:

New variation of the bank impersonation scam detected

We have observed a new variation of the bank impersonation scam where an SMS, appearing to be from ANZ, is sent to customers advising them to expect a call from ANZ relating to "transaction issues".

During the call, customers are prompted to click on a link, provided in another SMS, to assist in resolving these issues. This link leads to a fake ANZ website with a button to begin "ANZ Live Chat". This website may look very convincing. If the customer clicks on the button, software will be downloaded on the customer's device providing the scammer remote access to the device.

The scammer (still impersonating an ANZ employee), will ask the victim to log into their Internet Banking, allowing the scammer to capture the customer's login credentials. The scammer may also take over the session and perform transactions or ask the customer to transfer their money into a "safe" account.

Remember, ANZ will never ask you:

If you’ve received and responded to a message that you now believe is a scam, and have transferred money, shared your ANZ banking details and/or account credentials, contact ANZ immediately.

You can also report scams at Scamwatch.

For more information on how to protect yourself online, please visit the ANZ Security Centre.

Posted on 26 July 2023

Type: